Index Surge: Amplifying Your Insights

Stay updated with the latest trends and news across various industries.

Why Paying Less for Auto Insurance Might Just Be Your Best Move

Discover why saving on auto insurance could be the smartest financial decision you make this year! Don't miss out on potential savings!

The Hidden Costs of Cheap Auto Insurance: What You Need to Know

While low premium rates may seem attractive, cheap auto insurance often comes with hidden costs that can significantly impact your financial well-being. These policies may offer limited coverage or high deductibles, leaving you vulnerable in the event of an accident. According to statistics, drivers with inadequate coverage are at a greater risk of experiencing financial hardship after a collision. Moreover, many affordable policies lack essential features, such as rental car reimbursement or roadside assistance, which can lead to unexpected expenses when you find yourself in need.

Additionally, cheap auto insurance may also mean less reliable customer service. Insurers with lower rates often handle a higher volume of claims, resulting in longer wait times and less personalized support. This can be particularly frustrating when navigating the claims process after an accident. In some cases, budget-friendly insurers may even employ questionable tactics to deny claims altogether. Therefore, while it might be tempting to opt for the lowest premium, understanding these hidden costs is crucial in ensuring you receive the protection you truly need on the road.

Is Lower Auto Insurance Always Better? Key Factors to Consider

When it comes to purchasing auto insurance, many drivers naturally gravitate towards the option with the lowest premium. However, lower auto insurance rates can often come with significant trade-offs. Before settling on a policy, it's crucial to evaluate the extent of coverage, deductibles, and limits to ensure that you're getting adequate protection for your needs. Opting for cheaper insurance might lead to insufficient coverage, exposing you to higher out-of-pocket costs in the event of an accident.

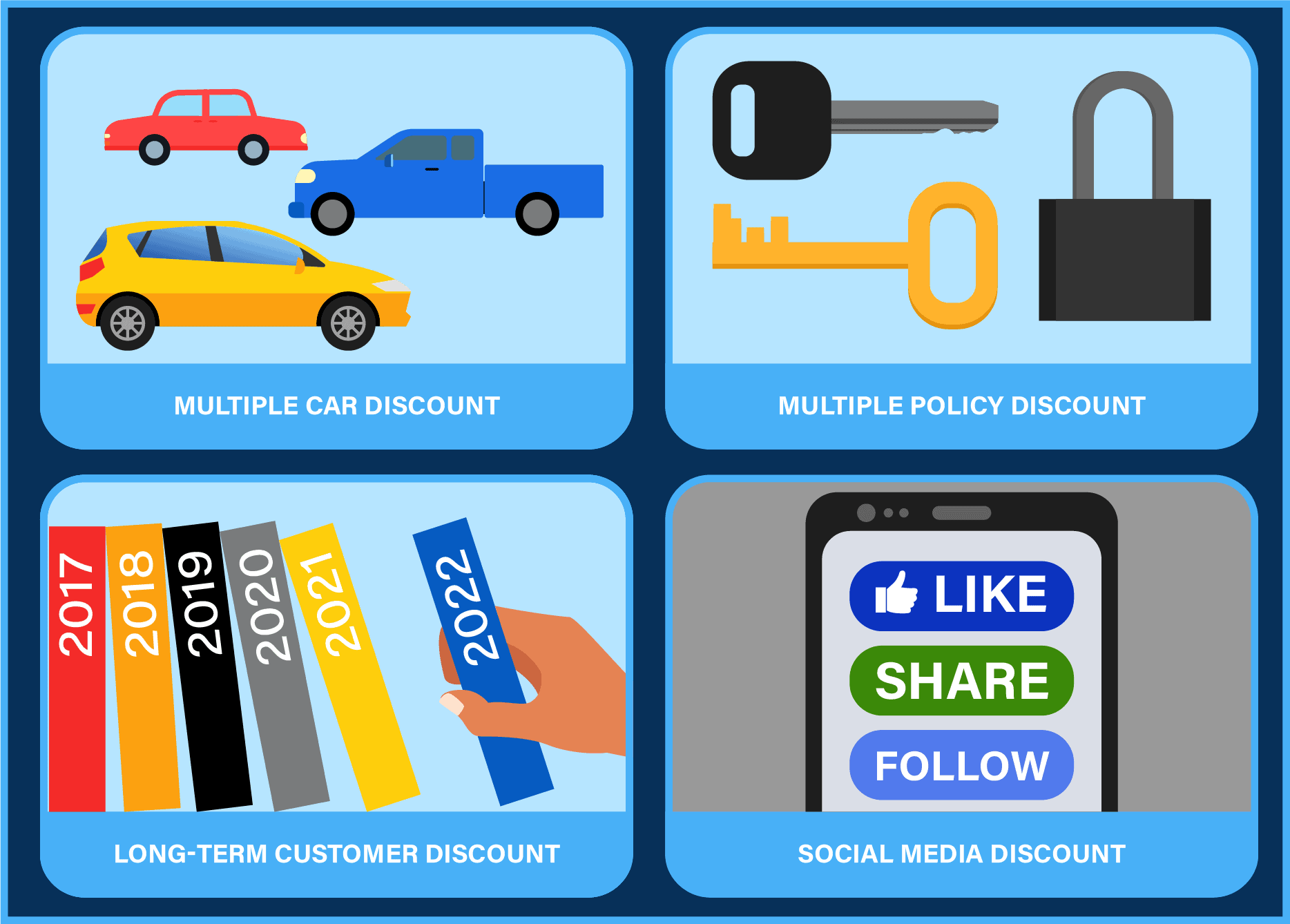

Several key factors should be considered when assessing auto insurance policies. These include coverage types, such as liability, collision, and comprehensive coverage; the driver's record and experience; and even the type of vehicle insured. Additionally, discounts for safe driving, good credit, and bundling policies can influence overall costs. It’s important to perform a thorough comparison of quotes from different providers while considering these factors to determine whether choosing a lower auto insurance policy truly aligns with your financial and personal safety goals.

How to Balance Affordability and Coverage in Your Auto Insurance

Finding the right auto insurance can often feel like a balancing act between affordability and coverage. When shopping for a policy, it's essential to assess your individual needs and budget. Start by comparing different insurance providers and their offerings. Make a list of what coverage you need—such as liability, collision, and comprehensive—and then evaluate which plans fit within your price range. Utilize online calculators and tools to estimate premiums and tailor your research to include discounts for good driving records, bundling policies, or other qualifying criteria that can reduce your costs.

Once you've identified a few viable options, consider conducting a cost-benefit analysis to weigh the coverage against the price. Review the limits of each policy and the deductibles involved. Are you comfortable with higher deductibles to keep monthly premiums lower? Or would you prefer a higher premium with lower out-of-pocket costs during an accident? It's crucial to strike the right balance so that you are not overpaying for coverage you may not need, but also sufficiently protected in case of unforeseen incidents.