Index Surge: Amplifying Your Insights

Stay updated with the latest trends and news across various industries.

Whole Life Insurance: A Safety Net or a Money Pit?

Discover if whole life insurance is your financial safety net or a costly mistake. Uncover the truth behind this complex policy!

Whole Life Insurance: Is It Truly the Best Safety Net for Your Family?

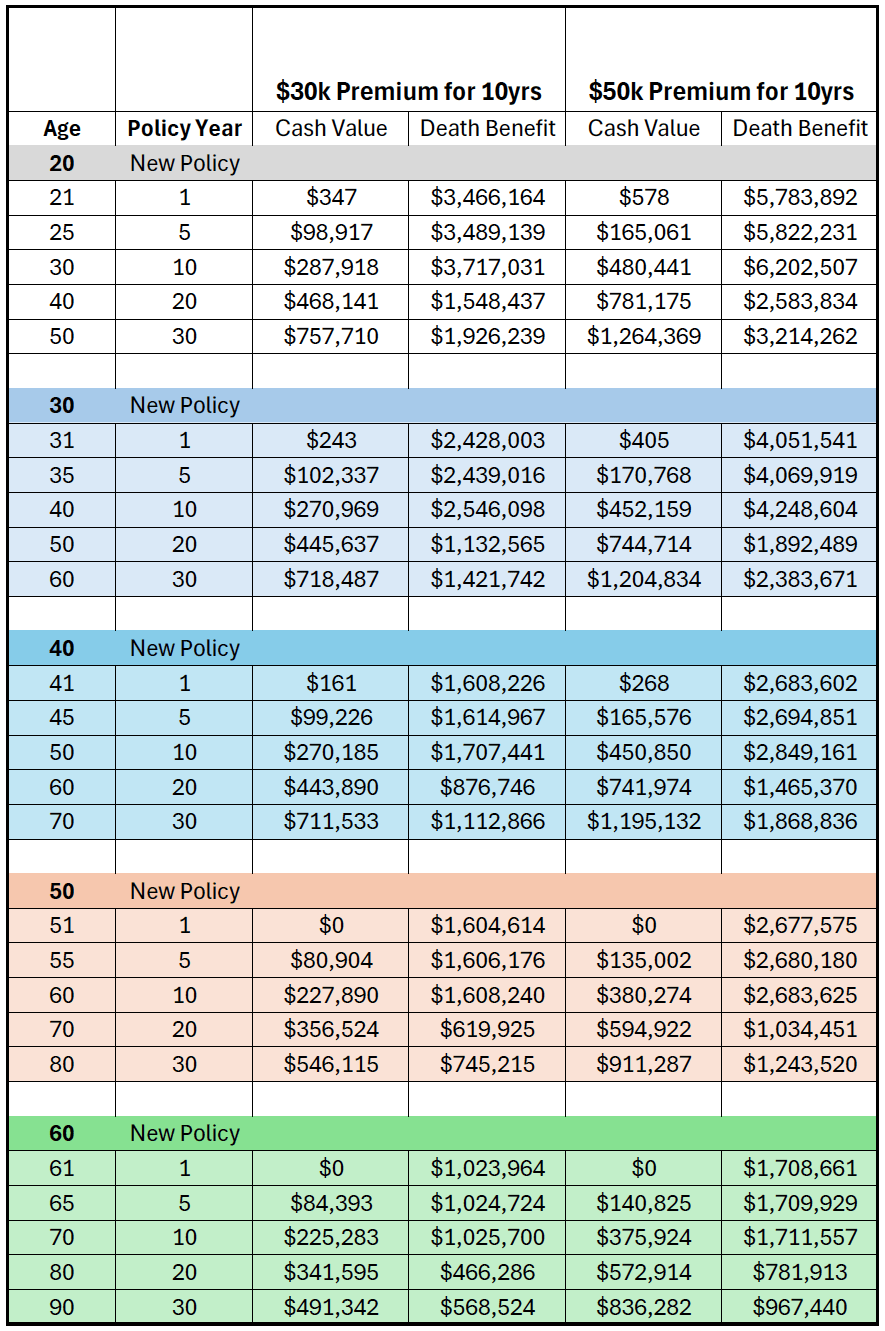

Whole life insurance is often touted as one of the best financial safety nets for families, providing both life coverage and a cash value component that grows over time. Unlike term life insurance, which provides coverage for a specified period, whole life insurance ensures that your family is financially protected no matter when you pass away. This type of coverage can be especially beneficial for families with young children or dependents who rely on your income, offering peace of mind knowing that they will have the financial resources needed to maintain their lifestyle in your absence.

However, it's crucial to weigh the costs and benefits of whole life insurance against other options. The premiums for whole life policies tend to be significantly higher than those for term policies, which might make it less accessible for some families. Additionally, while whole life insurance accumulates cash value, these returns are typically lower compared to potential gains from other investment avenues. As you evaluate your family's financial needs, consider the long-term implications and whether whole life insurance aligns with your overall financial strategy or if a more flexible approach might be a better fit.

The Real Costs of Whole Life Insurance: Investing or Wasting Money?

Whole life insurance often presents itself as a reliable financial tool, promising both a death benefit and a cash value accumulation over time. However, the real costs of whole life insurance can be quite significant. Premiums are generally much higher than those for term life insurance, which can lead to a substantial outflow of cash, especially in the early years. When you consider the opportunity cost of these investments, such as potential returns from stocks or bonds, one must ask: is this policy truly a wise investment or merely a financial drain?

In addition to inflated premiums, policyholders should also be wary of the hidden fees and interest charges associated with whole life insurance. Many policies come with surrender charges if you decide to cash out early, eating into your savings. Moreover, the growth of cash value is often sluggish compared to other investment vehicles, making the proposition seemingly less appealing. Ultimately, understanding the real costs of whole life insurance is crucial for anyone considering this route—deciding whether it's a solid addition to your financial portfolio or just a way to waste hard-earned money.

Whole Life Insurance vs. Term Insurance: Which Policy Fits Your Financial Goals?

When considering whole life insurance versus term insurance, it's crucial to evaluate your financial goals and needs. Whole life insurance is a permanent policy that provides lifelong coverage, along with a cash value component that grows over time. This makes it a strong choice for individuals looking for stability and long-term planning. On the other hand, term insurance offers coverage for a specific period—typically 10, 20, or 30 years—making it a more affordable option for those who need protection during a particular life stage, such as raising children or paying off a mortgage.

Determining which policy fits your financial goals involves assessing several factors:

- Budget: Whole life policies generally come with higher premiums, while term insurance offers lower costs.

- Duration of Need: Consider how long you require coverage; if short-term, term insurance may suffice.

- Investment Potential: If you seek a policy that also acts as a savings vehicle, whole life insurance could be the better choice.