Index Surge: Amplifying Your Insights

Stay updated with the latest trends and news across various industries.

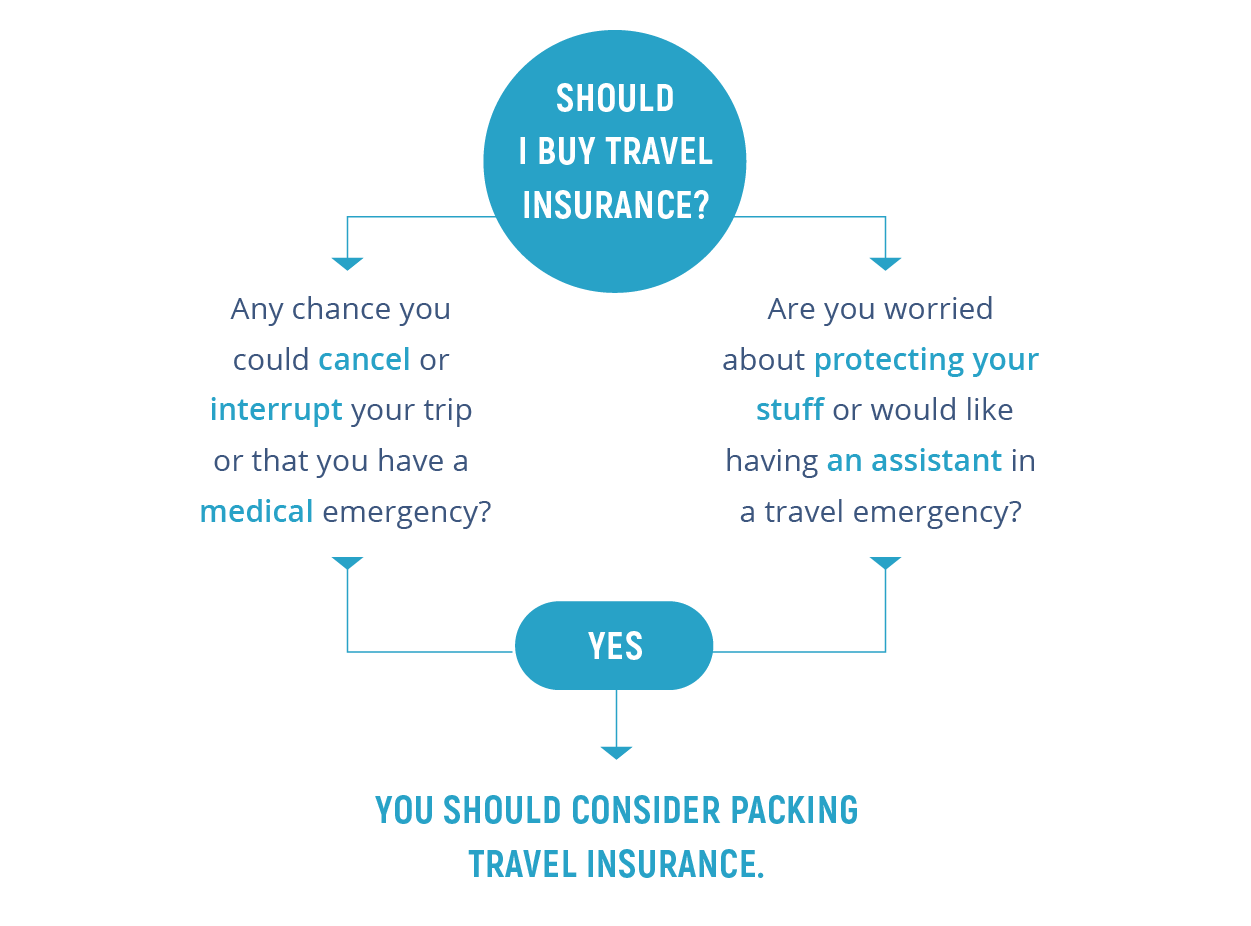

Travel Insurance: Your Vacation's Best Friend or Worst Nightmare?

Is travel insurance a lifesaver or a nightmare? Discover the truth behind your vacation’s best friend in this eye-opening guide!

10 Essential Reasons to Get Travel Insurance Before Your Next Adventure

When planning your next adventure, securing travel insurance should be at the top of your to-do list. Here are 10 essential reasons to consider:

- Protection Against Trip Cancellation: Unexpected events can force you to cancel your trip, and travel insurance can help reimburse non-refundable costs.

- Medical Emergencies: If you fall ill or get injured while traveling abroad, having travel insurance ensures that you receive the necessary medical care without facing exorbitant costs.

- Lost or Stolen Belongings: In the unfortunate event that your luggage is lost or stolen, travel insurance can cover the costs of replacing your personal items.

- Travel Delays: Delays can happen for various reasons, and travel insurance can compensate you for additional expenses incurred, such as accommodation or meals.

- Emergency Evacuations: In extreme situations, travel insurance will cover the costs for emergency evacuations, providing peace of mind while you explore the world.

Beyond financial protection, travel insurance also offers valuable support services. Here are more reasons to secure it:

- Assistance with Trip Interruption: If your trip is interrupted due to unforeseen circumstances, travel insurance can cover the costs of returning home quickly.

- Death or Disability Coverage: In the unfortunate event of a death or disability while traveling, insurance can provide valuable assistance and support to your loved ones.

- Covers Pre-existing Conditions: Many travel insurance plans offer options to cover pre-existing medical conditions, giving you additional security on your trip.

- 24/7 Support Services: With travel insurance, you have access to emergency hotlines for assistance anytime you need it.

- Peace of Mind: Knowing you are protected provides the confidence to enjoy your trip fully, making it an invaluable investment.

Travel Insurance Myths: What You Need to Know Before You Buy

When it comes to travel insurance, there are many myths that can lead travelers to make uninformed decisions. One common misconception is that you don't need travel insurance if you're healthy or if you're traveling to a safe destination. However, unexpected events such as natural disasters, sudden illness, or travel delays can happen to anyone, regardless of their health status or destination. Having travel insurance can provide peace of mind and financial security in the face of unforeseen circumstances.

Another myth is that travel insurance will automatically cover all kinds of issues, including pre-existing medical conditions. In reality, many policies come with specific exclusions and limitations. It's crucial to read the policy details and understand what is covered before making a purchase. Additionally, some travelers believe that their credit card offers sufficient coverage; while this may be true for certain situations, it often doesn't provide the comprehensive protection needed for unexpected events. Don't fall for these travel insurance myths—always do your research and ensure you choose a policy that fits your specific needs.

What Does Travel Insurance Really Cover? A Comprehensive Guide

When planning your next vacation, understanding what travel insurance really covers is essential for safeguarding your investment. Typically, travel insurance can cover a variety of unforeseen events, such as trip cancellations, medical emergencies, lost luggage, and travel delays. According to most policies, the specifics of coverage can vary significantly, so it’s crucial to read the fine print. Commonly covered reasons for trip cancellation include:

- Illness or injury

- Death of a family member

- Severe weather conditions

- Military deployment

In addition to trip cancellations, travel insurance often provides medical coverage while you're away. This is particularly important for international travelers, as healthcare costs can be exorbitant outside of your home country. Depending on the policy, you may find coverage that includes:

- Emergency medical treatment

- Evacuation to the nearest adequate facility

- Repatriation in case of serious illness

- 24/7 assistance services

Understanding these aspects will help you choose the right coverage to ensure peace of mind during your travels.