Index Surge: Amplifying Your Insights

Stay updated with the latest trends and news across various industries.

Paws Before Claws: Why Your Fur Baby Deserves Insurance

Protect your fur baby! Discover why pet insurance is essential for your peace of mind and your pet's health. Don’t wait—read more now!

Top 5 Reasons Pet Insurance is a Lifesaver for Your Fur Baby

Pet insurance can be a lifesaver for your furry companions, providing financial support during unexpected health crises. The first reason to consider pet insurance is cost savings. Veterinary bills can quickly add up, especially for emergencies or long-term health issues. With the right coverage, you can drastically reduce out-of-pocket expenses, ensuring that your pet receives necessary treatments without breaking the bank.

Another critical factor is peace of mind. Knowing that you have pet insurance allows you to make health decisions based on your fur baby’s needs rather than your financial situation. This assurance ensures that you won't have to make tough calls about your pet's health due to cost constraints, ultimately leading to better care and a healthier, happier pet. In conclusion, investing in pet insurance is vital for responsible pet ownership, allowing you to prioritize your pet's health above all else.

Understanding Pet Insurance: What Coverage Does Your Furry Friend Really Need?

Understanding pet insurance is crucial for pet owners who want to ensure the best care for their furry friends. With a variety of coverage options available, it's important to assess your pet's specific needs. Common types of coverage include accident and illness plans, which cover unforeseen medical issues that can arise. Additionally, some policies offer preventive care options, such as vaccinations and routine check-ups, that can help you maintain your pet's health over time. Evaluating these options can lead to better decision-making when it comes to investing in the ideal pet insurance policy.

When selecting a policy, consider the following factors to ensure your pet has the necessary coverage:

- Age and breed: Some policies might have age restrictions or breed-specific exclusions.

- Pre-existing conditions: Be aware that most insurers do not cover pre-existing health issues.

- Annual limits: Review the coverage limits and ensure they align with your expectations for both routine and emergency care.

By understanding what coverage your furry friend really needs and the details of your chosen policy, you can make informed decisions that enhance their health and well-being.

Is Pet Insurance Worth It? Breaking Down Costs vs. Benefits for Your Beloved Companion

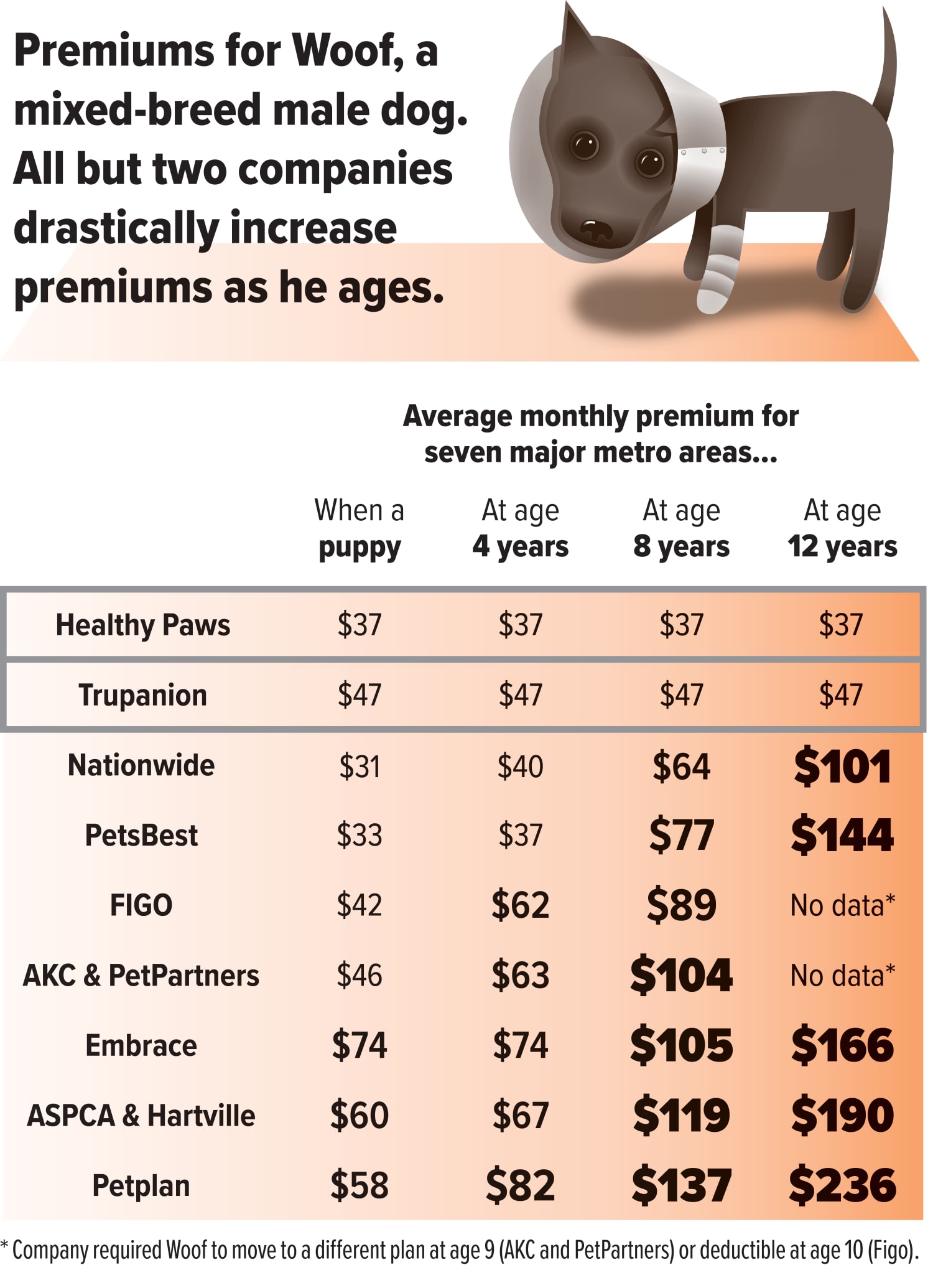

The question of whether pet insurance is worth it often arises among pet owners, especially as veterinary costs continue to rise. When considering the financial implications, it's essential to evaluate the potential costs versus the benefits. For instance, while monthly premiums can range from $30 to $70 for dogs, and somewhat less for cats, these costs can be offset by the savings on unexpected vet bills. A single emergency visit can easily exceed $1,000, making insurance a financially sound choice for those looking to mitigate risks associated with pet health issues.

Furthermore, understanding the various types of pet insurance plans available can help owners make informed decisions. Typically, there are three categories: accident-only plans, comprehensive plans, and wellness plans. Each offers distinct coverage levels and pricing structures. For example, while wellness plans cover routine check-ups and vaccinations, comprehensive plans typically include more extensive medical coverage. Evaluating your pet's health needs and your financial capability can guide you in selecting the most suitable option, ultimately determining if investing in pet insurance is worthwhile for you and your furry friend.