Index Surge: Amplifying Your Insights

Stay updated with the latest trends and news across various industries.

Navigating the Insurance Maze: Finding the Best Deal Without Losing Your Mind

Master the insurance maze and score the best deals without the stress. Unlock tips and tricks for savvy savings today!

Understanding Different Types of Insurance: What You Need to Know

When it comes to insurance, understanding the different types can significantly affect your financial well-being. There are several main categories of insurance, including health insurance, auto insurance, homeowners insurance, and life insurance. Each of these types serves a unique purpose, catering to various needs in unpredictable circumstances. For instance, health insurance ensures you have access to medical services without incurring prohibitive costs, while auto insurance protects you financially in the event of an accident. Understanding these categories is the first step in selecting the right insurance that fits your lifestyle.

Furthermore, it's crucial to consider the benefits and limitations of each type of insurance. For example, homeowners insurance typically covers damages to your home due to theft or natural disasters, but it may exclude certain risks unless additional coverage is purchased. Similarly, when purchasing life insurance, individuals must decide between term life, which covers a specific period, and whole life, which lasts for the policyholder's lifetime and includes an investment component. By evaluating the features and exclusions associated with each insurance type, you can make informed decisions to ensure you are adequately protected.

Top 5 Tips for Comparing Insurance Quotes Effectively

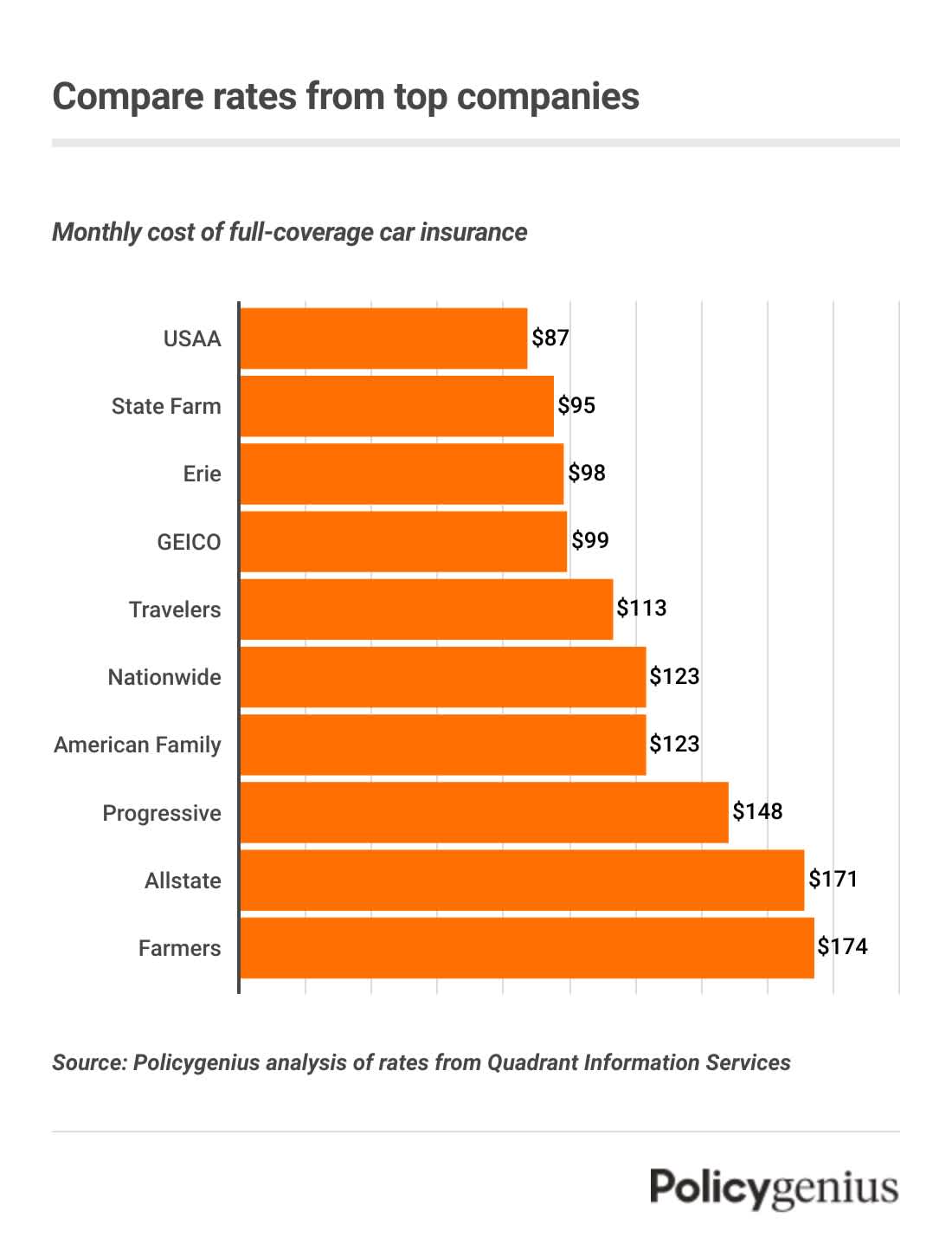

When it comes to finding the best insurance coverage, comparing insurance quotes can seem like a daunting task. However, by following a methodical approach, you can simplify the process and ensure you're getting the most value for your money. Tip 1: Start by gathering multiple quotes from various insurers. This will provide a broad perspective on your options, helping you identify which companies offer competitive rates. Tip 2: Utilize online comparison tools to streamline this process; these platforms enable you to view multiple quotes side by side, making it easier to assess coverage levels and premiums.

Tip 3: Pay close attention to the details of each policy. It's essential to compare not just the prices but also the coverage limits, deductibles, and exclusions. A lower premium might not be worth it if the coverage does not meet your needs. Tip 4: Don't hesitate to ask questions or clarify details with insurance agents; their expertise can often reveal potential savings or options you might have overlooked. Lastly, Tip 5: Take the time to read customer reviews and ratings of the insurance providers you're considering, as this can give you insight into their service quality and reliability.

Common Insurance Myths Debunked: What to Ignore and What to Believe

Insurance is often surrounded by a cloud of misconceptions that can lead consumers to make uninformed decisions. One common myth is that you don't need renters insurance if you live in a rented apartment. Many believe that the landlord's insurance covers their personal belongings, which is false. In reality, the landlord’s policy only covers the structure and not your personal possessions. Therefore, investing in renters insurance is crucial to protect your valuables from theft or damage.

Another prevalent misconception is that all insurance policies are the same. In truth, policies can vary widely in coverage, exclusions, and premiums. It's vital to read the fine print and understand what each policy entails. Some policies may offer additional benefits like roadside assistance or equipment breakdown coverage, while others might not include these options at all. By doing thorough research, you can find a policy that best caters to your specific needs, debunking the myth that one size fits all in insurance.