Index Surge: Amplifying Your Insights

Stay updated with the latest trends and news across various industries.

Is Pet Insurance a Scam or a Safety Net?

Discover the truth about pet insurance—scam or safety net? Uncover facts and tips to protect your furry friend today!

Is Pet Insurance Worth It? Breaking Down the Costs and Benefits

When considering pet insurance, it's crucial to evaluate both the costs and benefits associated with it. Many pet owners might initially balk at the monthly premiums, which can range from $20 to $100 depending on the coverage level and the pet's breed and age. However, unexpected veterinary expenses can skyrocket, especially for serious conditions or emergencies. For instance, a single surgery can easily exceed $1,000. Thus, having pet insurance can provide peace of mind by ensuring that you won't have to make a heart-wrenching decision based on finances alone.

On the benefits side, pet insurance can cover a wide array of services, including routine check-ups, vaccinations, and treatment for chronic conditions. Most plans also offer accident coverage, which can safeguard against financial burdens from unforeseen incidents. It's essential to carefully read policy details to understand exclusions and waiting periods. Ultimately, the decision of whether pet insurance is worth it may depend largely on your financial situation, your pet's health, and your willingness to take on risk. Weighing these factors will help you determine if investing in pet insurance is the right choice for you.

How to Choose the Right Pet Insurance: Key Factors to Consider

Choosing the right pet insurance is essential for ensuring the health and well-being of your furry friend. Pet insurance can help mitigate unexpected veterinary costs, but not all policies are created equal. Here are some key factors to consider when selecting a plan:

- Coverage Options: Evaluate whether the policy covers accidents, illnesses, and routine care. Some plans offer comprehensive coverage, while others may focus solely on emergencies.

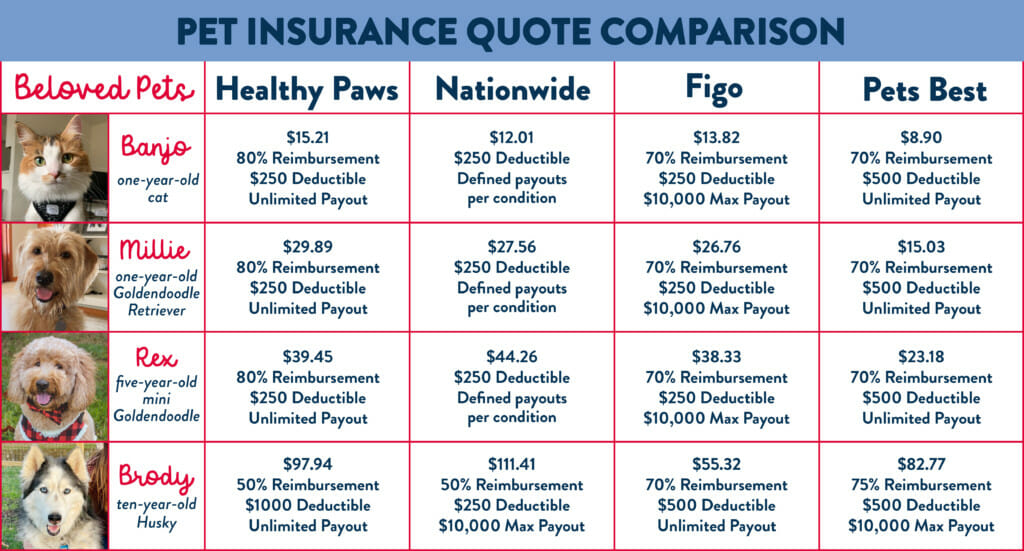

- Premiums and Deductibles: Assess the monthly premium and the deductible amount. Finding a balance that fits your budget while offering adequate coverage is crucial.

Another important factor is the provider's reputation and customer service. Look for reviews and testimonials from other pet owners to gauge their experiences. A company with a high level of customer satisfaction will be more reliable when you need to file a claim. Additionally, consider the network of veterinarians that accept the insurance. A wider network allows you to choose trusted professionals for your pet's care.

Lastly, check for any exclusions or limitations in the policy terms. Some insurers may not cover pre-existing conditions or specific breeds. By understanding these details upfront, you can avoid surprises down the road and ensure that your pet receives the best possible care when it matters most.

Is Pet Insurance a Scam? Common Myths and Misconceptions Explained

Many pet owners often wonder, is pet insurance a scam? This question typically arises due to the abundance of myths and misconceptions surrounding pet insurance policies. One common myth is that these policies are too expensive and do not provide adequate coverage. In reality, many providers offer a range of plans catering to different budgets and needs. Additionally, by having insurance, you can avoid steep out-of-pocket expenses for unexpected veterinary care, making it a valuable investment in your pet's health.

Another widespread misconception is that pet insurance only benefits pets with chronic conditions. This is not true; most insurance plans are designed to cover a wide variety of situations, including accidents, illnesses, and routine check-ups. Pet insurance aims to alleviate the financial burden of veterinary care, which can become overwhelming. Understanding the details of how these policies work can help pet owners make informed decisions, countering the skepticism surrounding pet insurance.