Index Surge: Amplifying Your Insights

Stay updated with the latest trends and news across various industries.

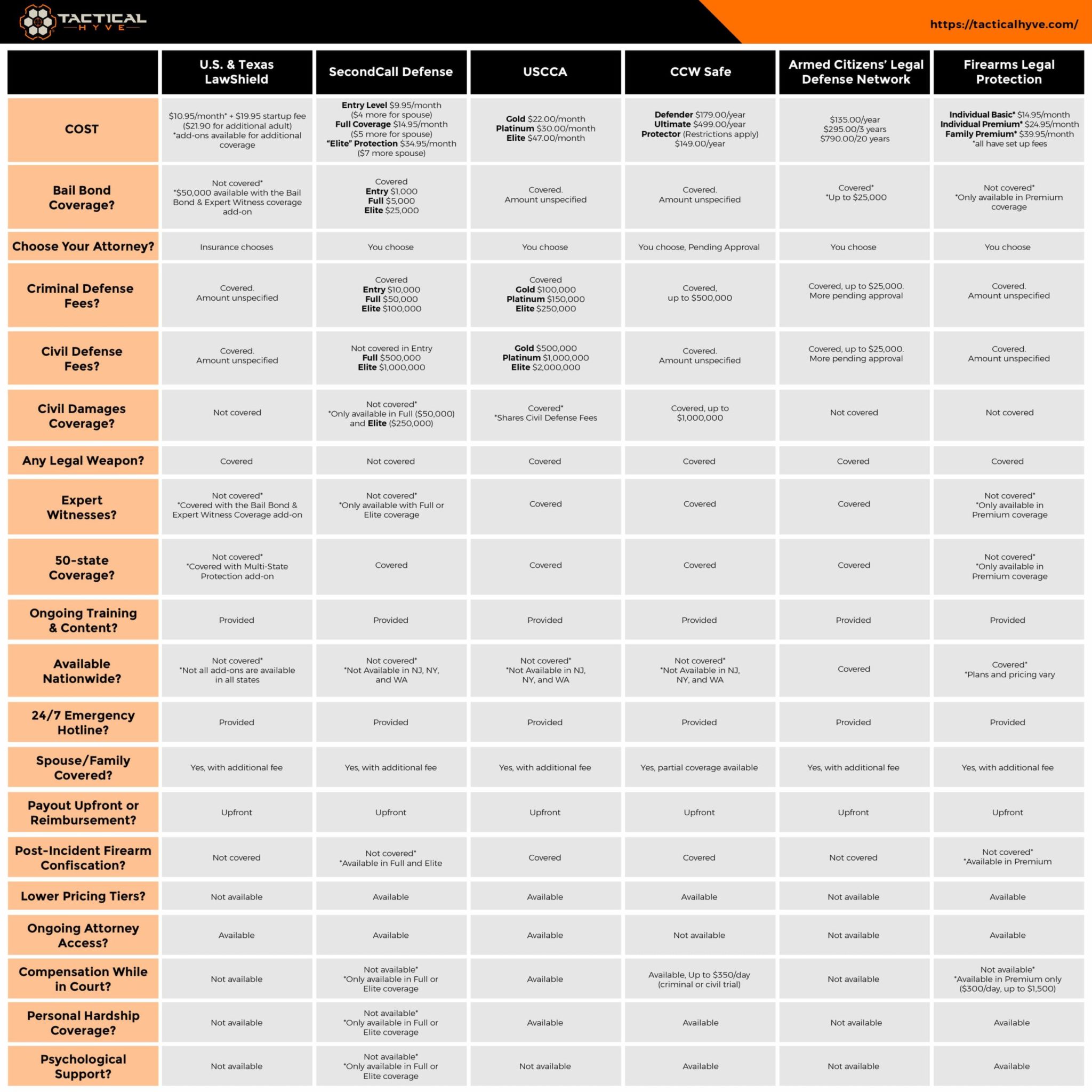

Insurance Showdown: Why Paying Less Might Mean Getting More

Discover why cheaper insurance can deliver more value. Uncover secrets to get the best coverage without breaking the bank!

Understanding the True Value of Insurance: Is Cheaper Always Better?

When it comes to selecting insurance, many individuals instinctively gravitate towards options that promise the lowest premiums. However, understanding the true value of insurance requires a deeper analysis than merely comparing price tags. Cheaper plans may offer limited coverage, leaving policyholders vulnerable in times of need. It's essential to evaluate what is included in the policy, such as deductibles, coverage limits, and exclusions, alongside the costs. An insurance policy that seems economical may end up being more expensive in the long run if it fails to provide adequate protection.

Moreover, the value of insurance is not just about financial savings but also about peace of mind. Comprehensive coverage can prevent significant out-of-pocket expenses in adverse situations, such as accidents or natural disasters. Consider factors such as customer service, claim settlement ratios, and policy flexibility when assessing your options. Remember, sometimes investing a bit more in a robust insurance plan can safeguard against unforeseen challenges, making it a smarter financial decision in contrast to choosing a cheaper, less reliable alternative.

The Hidden Benefits of Lower-Priced Insurance Policies

When considering insurance options, many individuals overlook the hidden benefits of lower-priced insurance policies. While the initial thought may be that cheaper options mean fewer benefits, this isn't always the case. Lower-priced policies often come with essential coverage that can suit the needs of budget-conscious consumers. For those just starting out, such as young drivers or new homeowners, these policies can provide a reasonable safety net without breaking the bank.

Additionally, opting for a lower-priced insurance plan can lead to significant savings that may be better used elsewhere. By keeping insurance costs down, individuals can allocate funds towards other priorities such as retirement savings, education, or managing daily expenses. Furthermore, many lower-priced policies offer flexibility in terms of payment plans, allowing policyholders to pay for what they need without compromising their financial stability. Embracing lower-cost insurance alternatives not only addresses immediate coverage needs but also supports long-term financial health.

What You Need to Know Before Choosing a Low-Cost Insurance Plan

Choosing a low-cost insurance plan may seem like a tempting option, especially when you're trying to save money. However, it's essential to understand the coverage you need before making a decision. Low-cost plans often come with limited coverage, exclusions, or high deductibles that can lead to unexpected out-of-pocket expenses when you need care. Before you commit, consider evaluating your current needs, reviewing your health history, and estimating potential future costs. This will help you find a plan that offers sufficient protection without unexpected financial burdens.

Additionally, don’t forget to compare multiple insurance providers to ensure you're getting the best value for your money. Look for reviews and ratings from other customers to gauge the quality of their services. Here are a few key factors to keep in mind when comparing low-cost insurance plans:

- Coverage Limits: Ensure the plan covers essential services you may need.

- Network Providers: Check if your preferred doctors and hospitals are in-network.

- Customer Service: Investigate the insurer’s reputation for handling claims and customer inquiries.

By taking the time to research and compare, you can find a low-cost insurance plan that meets your needs without sacrificing quality.