Index Surge: Amplifying Your Insights

Stay updated with the latest trends and news across various industries.

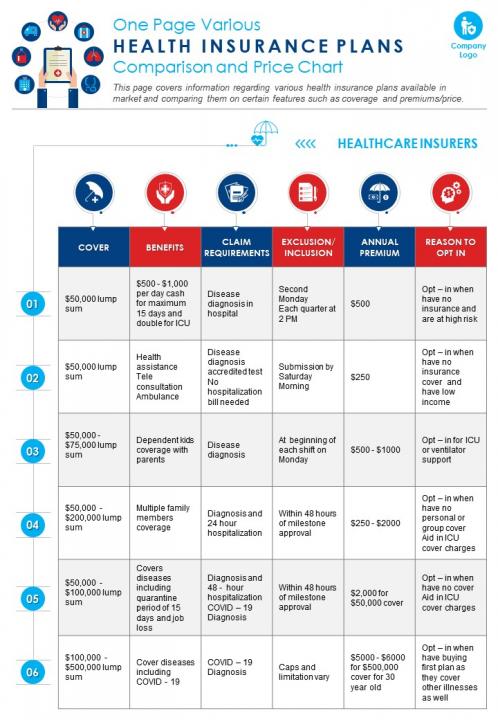

Insurance Showdown: Finding the Best Bang for Your Buck

Discover the ultimate guide to insurance savings! Uncover the best deals and maximize your value in our Insurance Showdown. Don't miss out!

Top 5 Factors That Determine Your Insurance Premium: What You Need to Know

Understanding the factors that determine your insurance premium is crucial for making informed decisions about your coverage. Here are the top five factors that can significantly influence the cost of your insurance:

- Your Age: Younger individuals often face higher premiums due to a lack of driving experience or increased health risks, while older adults may benefit from lower rates depending on their health and claim history.

- Your Driving Record: A clean driving record can lead to lower premiums, whereas having accidents or traffic violations can increase your rates substantially.

Additionally, other critical elements come into play.

- Your Credit Score: Insurers often use credit scores as a predictor of risk, with higher scores resulting in better rates.

- Type of Coverage: The level of coverage you choose—whether it's basic liability or comprehensive protection—will also impact your premiums.

- Your Vehicle: The make, model, and year of your car can affect your premium; vehicles with high safety ratings usually cost less to insure.

By being aware of these factors, you can better navigate the complexities of insurance pricing and potentially save money on your premiums.

Insurance Myths Debunked: Are You Overpaying for Coverage?

Insurance is often shrouded in misconceptions that can lead consumers to overpay for coverage. One common myth is that all insurance policies are the same, which couldn't be further from the truth. Different insurers offer various policies with unique terms, coverage limits, and premiums. This means that if you're sticking with one provider out of habit, you might miss out on better deals that suit your needs more effectively. By shopping around and comparing multiple quotes, you can identify coverage that provides similar benefits at a lower rate.

Another prevalent myth is that a higher premium guarantees better coverage. In reality, overpaying for coverage does not always equate to comprehensive protection. Some consumers believe that inflation of premium costs ensures higher payouts in the event of a claim. However, the claims process and payout structure depend more on the specifics of a policy rather than the amount paid in premiums. Therefore, it's essential to read the fine print and understand what is actually covered, rather than assuming that a costly premium means superior protection.

How to Compare Insurance Policies: A Step-by-Step Guide to Finding the Best Value

When it comes to comparing insurance policies, the first step is to determine your specific needs. Consider the type of coverage you require, whether it's health, auto, home, or life insurance. Make a list of essential features that you would like to have in your policy. Next, collect quotes from multiple providers; most companies offer free online quotes which make this step straightforward. As you gather this information, create a comparison chart to help visualize your options side by side.

Once you have gathered all the information, analyze the key factors such as premium costs, deductibles, policy limits, and coverage exclusions. Pay particular attention to customer reviews and the financial stability of each insurer. Additionally, consider contacting a few agents to clarify any terms or ask for advice. To summarize, the comparison process involves three main steps:

- Identify your needs and gather quotes

- Create a comparison chart

- Analyze the details and make an informed choice