Index Surge: Amplifying Your Insights

Stay updated with the latest trends and news across various industries.

Home Insurance: Don’t Get Caught With Your Roof Down

Protect your home from unexpected disasters! Discover essential tips on home insurance and avoid costly mistakes with our latest insights.

Understanding Home Insurance: Key Coverage Areas You Need to Know

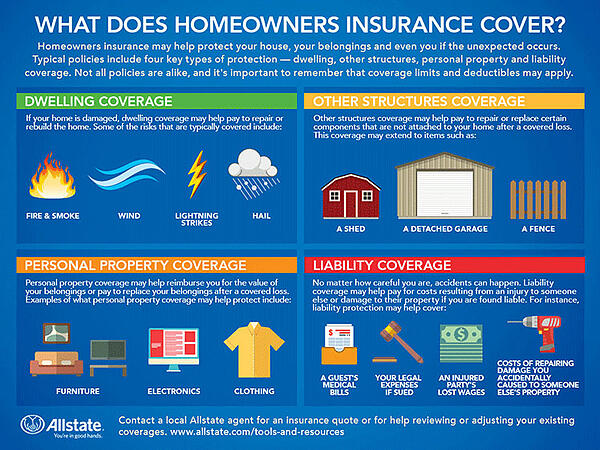

Understanding home insurance is crucial for protecting your most valuable asset—your home. Home insurance typically covers several key areas, including dwelling coverage, which pays for damage to your home structure due to events like fire, theft, or natural disasters. Additionally, personal property coverage helps replace belongings that are stolen or damaged, while liability coverage protects you from legal claims arising from injuries or accidents that occur on your property. It's essential to review these coverage areas thoroughly to ensure you have adequate protection.

Another important aspect of home insurance is additional living expenses coverage, which provides financial assistance for temporary housing if your home becomes uninhabitable due to a covered event. Additionally, consider optional coverages such as flood insurance or earthquake insurance, especially if you live in high-risk areas. Understanding these key coverage areas will empower you to make informed decisions and tailor your policy to suit your specific needs, ensuring peace of mind for you and your family.

Top 5 Common Home Insurance Myths Debunked

When it comes to home insurance, misconceptions abound. One of the most prevalent myths is that home insurance automatically covers all types of damage. In reality, standard policies often exclude certain risks, such as earthquakes and flooding, which require separate coverage. Homeowners should carefully review their policies to understand what is covered and what isn't, as assuming you have blanket protection can lead to significant financial surprises when disaster strikes.

Another common myth is that the value of your home determines your insurance premium. While the home's value is a factor, insurers primarily consider the cost to rebuild the house, not market value. This means factors like local construction costs and the home’s specific features—such as roofs, plumbing, and more—play crucial roles in determining your premium. By debunking these myths, homeowners can make informed decisions and better protect their investments.

Is Your Home Insurance Policy Adequate? 10 Questions to Ask Yourself

When it comes to protecting your home, understanding whether your home insurance policy is adequate is crucial. Start by evaluating your current coverage and consider asking yourself key questions. Is my policy tailored to reflect the current value of my home? As property values can change over time, ensuring your coverage matches the current market value is essential. Additionally, does my policy cover the full replacement cost? This means you should be able to rebuild your home to its original state without facing out-of-pocket expenses.

Next, assess the additional factors that may influence your coverage. What personal property is included in my policy? Determine if high-value items such as jewelry or artwork are covered adequately. Furthermore, does my home insurance address potential natural disasters in my area? If you live in a region prone to floods, earthquakes, or hurricanes, specialized coverage may be necessary. Lastly, frequently review your policy and ask, have my needs changed? Life events, such as renovations or family changes, can affect your insurance requirements significantly.