Index Surge: Amplifying Your Insights

Stay updated with the latest trends and news across various industries.

Discounts that Make You Smile: How to Save on Auto Insurance

Unlock huge savings on auto insurance! Discover discounts that will make you smile and keep your wallet happy today!

Top 5 Discounts You Might Be Missing on Your Auto Insurance

When it comes to saving money on your auto insurance, there are often hidden opportunities that policyholders overlook. Understanding the Top 5 Discounts You Might Be Missing on Your Auto Insurance can significantly reduce your premiums, allowing you to keep more cash in your pocket. Here are some discounts you should inquire about:

- Safe Driver Discount: If you've maintained a clean driving record free of accidents or tickets, you might qualify for this valuable discount.

- Bundling Discount: Consider packaging your auto insurance with other insurance products, like home or renter's insurance, to enjoy lower rates.

- Low Mileage Discount: If you drive less than the average number of miles per year, many insurers reward this behavior with reduced premiums.

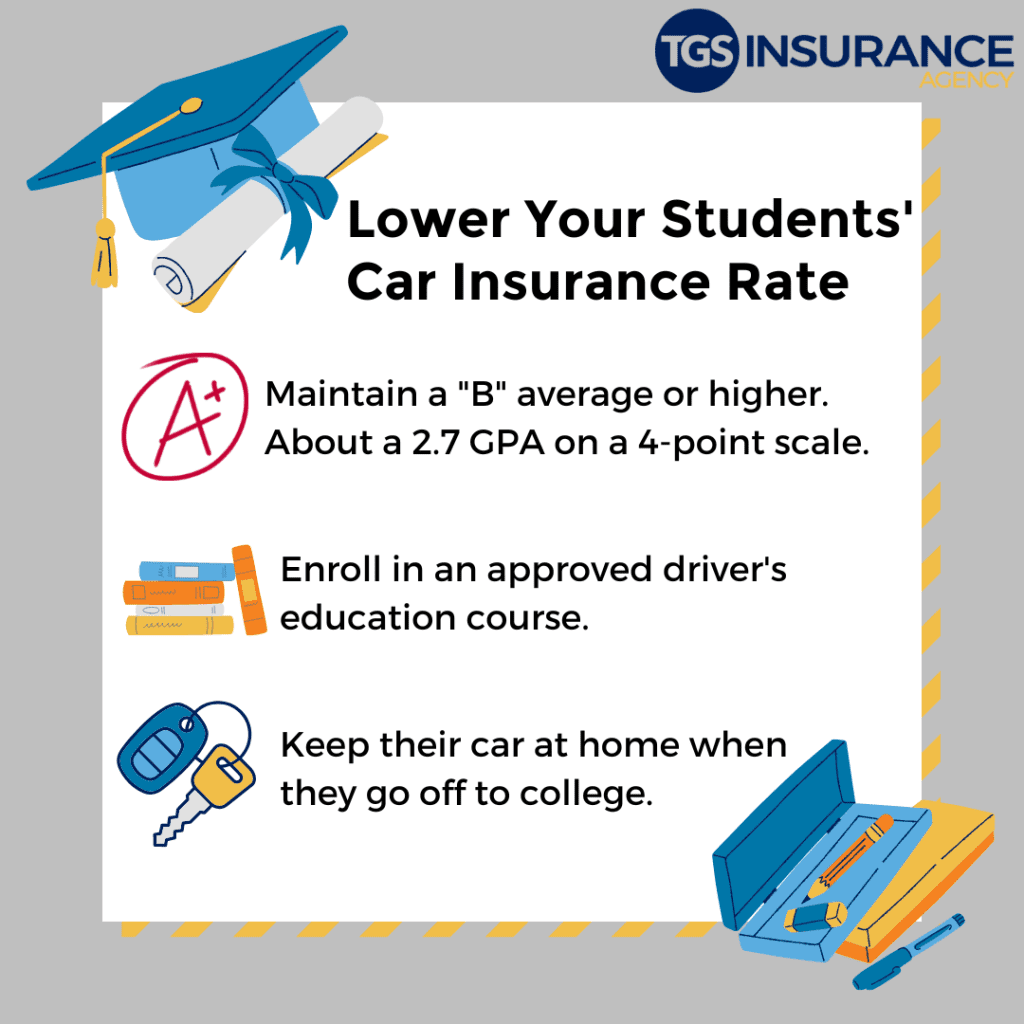

- Good Student Discount: Students who maintain a high GPA may qualify for this discount, which recognizes responsible behavior.

- Military Discount: Many providers offer special rates for active military members and veterans.

How to Shop Smart: A Guide to Finding the Best Auto Insurance Discounts

Shopping for auto insurance can often feel overwhelming, but it doesn’t have to be. Finding the best auto insurance discounts is crucial for ensuring you get the best value for your money. Start by researching the types of discounts available from various insurers. Common discounts include safe driver discounts, multi-policy discounts, student discounts, and low-mileage discounts. Take the time to make a list of these potential savings and compare them across different providers to ensure you are not missing out on any opportunities to save.

Once you have a list of available discounts, shopping smart means doing thorough research and shopping around. Utilize online comparison tools that allow you to see quotes from multiple insurers side by side. Additionally, don’t hesitate to contact insurance agents directly to inquire about any unpublished discounts or promotions. Remember that your driving record, vehicle type, and even your credit score can influence the rates you receive, so be sure to present your information accurately. By combining various discounts and making informed choices, you can significantly lower your auto insurance premium.

Are You Eligible? Common Auto Insurance Discounts You Should Ask About

When it comes to saving on your auto insurance premiums, understanding the different types of discounts available can make a significant difference in your overall costs. Many insurance providers offer a variety of discounts that policyholders may not be aware of. Common auto insurance discounts you should inquire about include safe driver discounts, multi-policy discounts, and good student discounts. For instance, if you have a clean driving record, you may qualify for a safe driver discount, which can lead to considerable savings.

Additionally, many insurers provide discounts for bundling multiple policies, such as auto and home insurance. This can not only simplify your insurance needs but also lower your total premium costs. Good student discounts are also prevalent, rewarding young drivers who maintain a high GPA. Therefore, don't hesitate to ask your insurance agent about any auto insurance discounts you might be eligible for, as every little bit helps in reducing your out-of-pocket expenses.