Index Surge: Amplifying Your Insights

Stay updated with the latest trends and news across various industries.

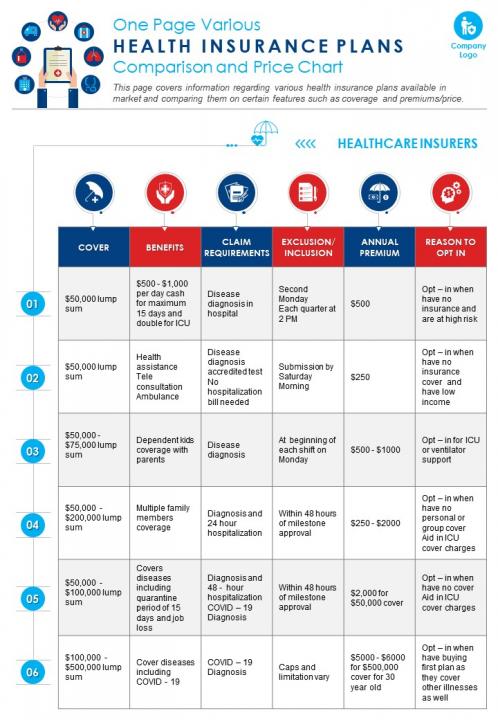

Comparison Conundrum: Decoding Insurance Decisions

Unlock the secrets to smarter insurance choices! Dive into the ultimate guide that simplifies your coverage comparison.

Understanding the Key Differences Between Life and Health Insurance

Life insurance and health insurance serve different purposes, yet both are essential components of a comprehensive financial plan. Life insurance provides financial protection to your beneficiaries in the event of your untimely demise, ensuring they are not burdened with debts or loss of income. Typically, it pays out a lump sum to the designated beneficiary, which can be used to cover living expenses, pay off debts, or fund future needs, such as a child's education or retirement for a spouse.

In contrast, health insurance is designed to cover medical expenses and protect against high healthcare costs. This type of insurance typically includes a range of services such as hospital stays, doctor visits, preventive care, and medications. With the rising cost of healthcare, having adequate health insurance can mean the difference between accessible care and financial hardship due to unexpected medical expenses. Understanding these fundamental differences allows individuals to make informed decisions based on their unique needs and circumstances.

Top 5 Factors to Consider When Choosing the Right Auto Insurance

Choosing the right auto insurance is crucial for protecting yourself and your vehicle. To make an informed decision, you need to consider several factors that can significantly impact your coverage and premium rates. Here are the top 5 factors to consider:

- Coverage Levels: Evaluate the different types of coverage available, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Selecting the right combination will ensure you have adequate protection in various situations.

- Deductibles: The deductible is the amount you'll pay out of pocket before your insurance kicks in. A higher deductible can lower your premium, but it also means you'll need more savings in case of an accident.

- Discounts: Many insurance providers offer discounts for safe driving, bundling policies, or having a good credit score. Always inquire about available discounts to lower your premium costs.

- Customer Service: Research the insurer's customer service reputation. Look into their responsiveness and claims process to ensure that you'll receive support when you need it most.

- Financial Stability: Review the financial strength of the insurance company by checking ratings from independent agencies. A financially sound insurer is more likely to be able to pay claims when necessary.

Is Bundling Insurance Policies Really Worth It?

When considering whether bundling insurance policies is truly worth it, it's essential to weigh both the potential savings and the benefits of comprehensive coverage. Many insurance companies offer discounts for bundling multiple policies—such as home, auto, and life insurance—which can lead to significant savings over time. Additionally, having all your policies with one provider simplifies management and increases your convenience, making it easier to track payments, claims, and policy renewals.

However, it’s crucial to analyze the specifics of each policy before deciding to bundle. While the financial incentives are appealing, some bundled policies may not offer the best coverage options for your individual needs. Always read the fine print and compare the bundled rates against standalone policies to determine if you’re receiving adequate coverage. Ultimately, bundling insurance policies can be advantageous, but informed decision-making is key to ensuring you get the most value out of your insurance investment.