Index Surge: Amplifying Your Insights

Stay updated with the latest trends and news across various industries.

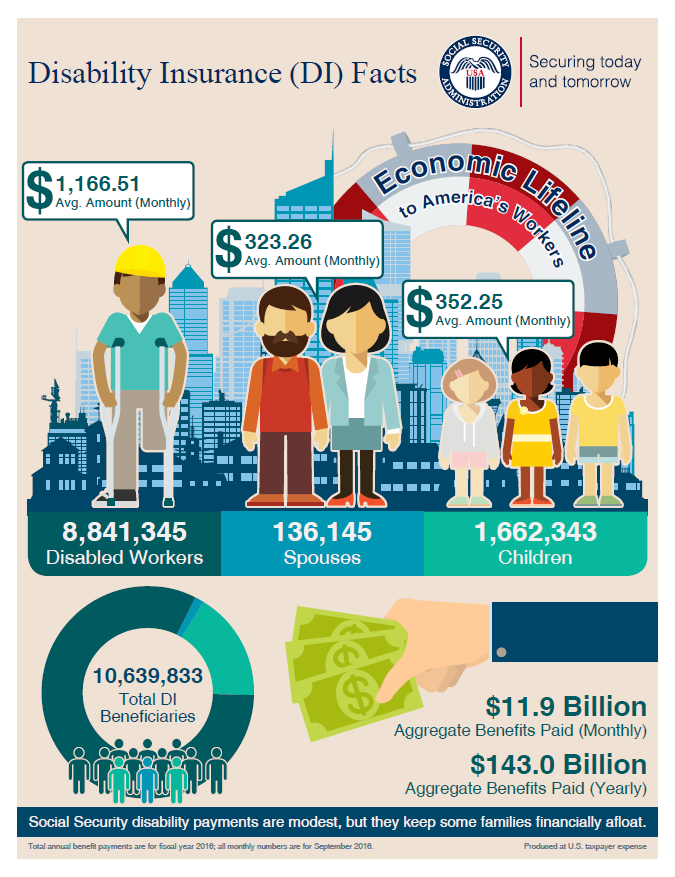

Disability Insurance: Your Safety Net for Life's Curveballs

Discover how disability insurance can protect your income and secure your future when life takes an unexpected turn. Don't miss out!

Understanding Disability Insurance: What You Need to Know

Disability insurance is a vital financial safeguard that provides income protection in the event you become unable to work due to a disability. Understanding the nuances of this type of insurance can help you make informed decisions about your financial future. With various policy options available, individuals must evaluate their specific needs, including the definition of disability offered, the elimination period before benefits kick in, and the duration of coverage. Key terms to familiarize yourself with include short-term disability insurance, which typically covers a portion of your salary for a limited duration, and long-term disability insurance, which extends coverage for several years or until retirement age.

Choosing the right disability insurance involves assessing your financial obligations and lifestyle needs. To simplify the process, consider the following steps:

- Analyze your current expenses and income.

- Determine how much coverage you will need to maintain your lifestyle.

- Research different policies and providers to find the best fit.

- Consult with a financial advisor to clarify any uncertainties.

Top 5 Reasons Why Disability Insurance is Essential for Your Financial Security

Disability insurance is often overlooked, yet it plays a crucial role in safeguarding your financial future. One of the top reasons to consider investing in this type of coverage is its ability to provide a steady income when you're unable to work due to injury or illness. Without disability insurance, you risk jeopardizing your financial stability, especially if you rely on your paycheck to meet monthly expenses. The peace of mind that comes from knowing you have a safety net can help prevent financial strain during challenging times.

Secondly, disability insurance can help cover essential expenses, such as mortgage payments, utilities, and medical bills, allowing you to focus on recovery. When evaluating your financial security, it's important to consider that about 1 in 4 adults will experience a disability before reaching retirement age. This statistic underscores the importance of having a plan in place. By investing in disability insurance, you're not just protecting yourself; you're also securing your family’s future against unexpected hardships.

Is Disability Insurance Right for You? Key Questions to Consider

When considering whether disability insurance is right for you, it's essential to evaluate your personal circumstances. Ask yourself key questions like:

- What would happen to my income if I became unable to work due to an illness or injury?

- Do I have enough savings to sustain my lifestyle during a long-term absence from work?

- What are my current and future financial obligations, such as a mortgage or family support?

Additionally, it's crucial to assess the type and extent of coverage you might need. Consider factors such as:

1. The percentage of your income you would like to replace, since most policies provide around 60-70% of your pre-disability earnings.

2. The waiting period before benefits begin, which can vary between policies.

3. The duration of coverage, with options ranging from short-term to long-term disabilities. By thoughtfully considering these aspects, you can determine if disability insurance aligns with your financial planning and risk management needs.