Index Surge: Amplifying Your Insights

Stay updated with the latest trends and news across various industries.

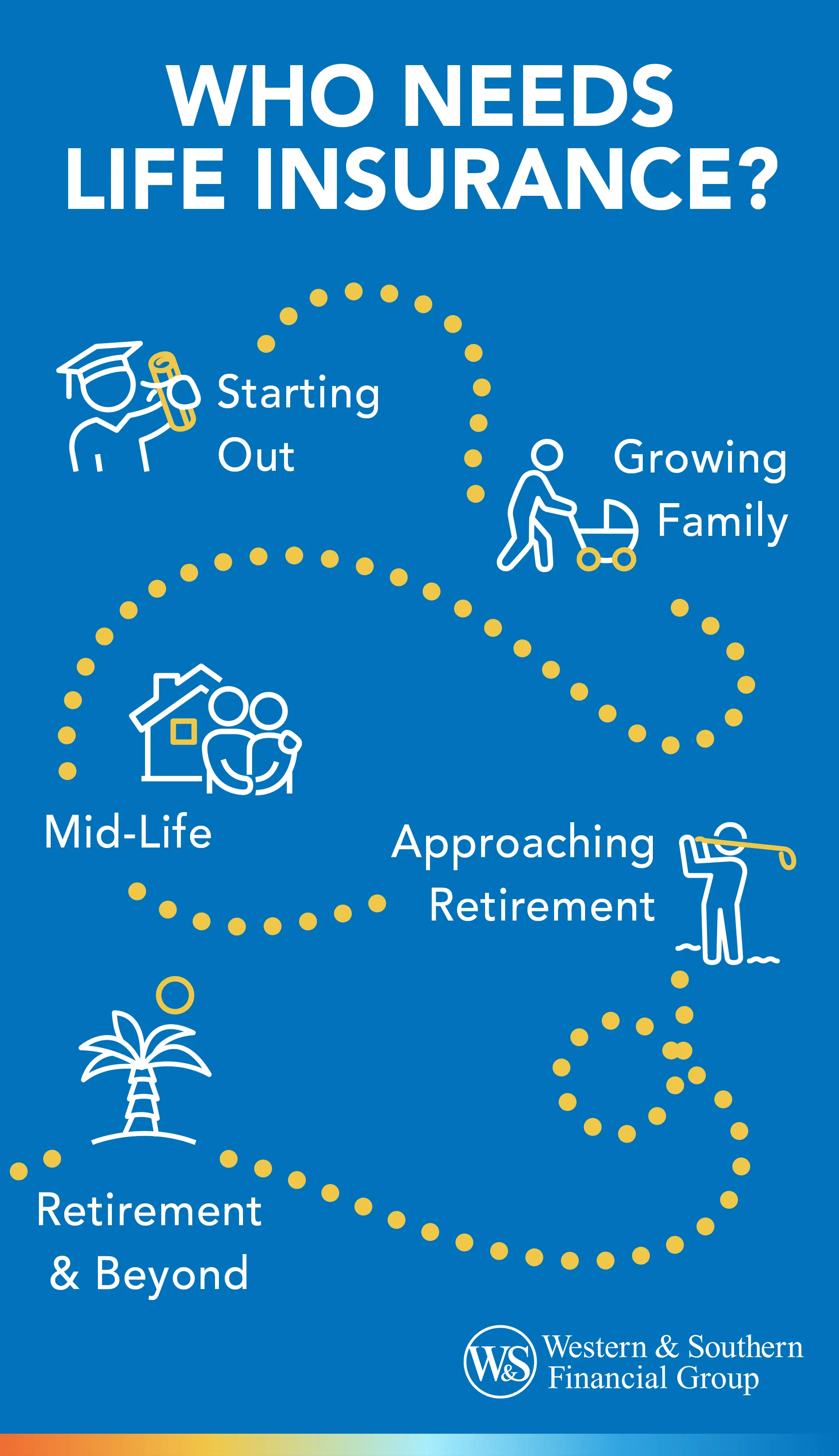

Why Your Life Insurance Policy is the Best Seatbelt You’ll Ever Buy

Discover why your life insurance policy is the ultimate safety net—more valuable than any seatbelt! Click to secure your peace of mind.

How Life Insurance Acts as Your Financial Safety Net

Life insurance serves as a crucial financial safety net for individuals and families, providing peace of mind in times of uncertainty. In the event of a policyholder's untimely demise, life insurance ensures that beneficiaries receive a lump sum payment that can help cover essential expenses such as mortgage payments, educational costs, and daily living expenses. This financial support can prevent loved ones from facing significant hardships and debt during an already challenging time, allowing them to focus on healing rather than financial burdens.

Moreover, life insurance can also play a pivotal role in long-term financial planning. Many policies accumulate cash value over time, which can be borrowed against or withdrawn in times of need. This feature acts as an additional layer of financial safety, giving policyholders a potential source of funds for emergencies, investments, or retirement planning. By incorporating life insurance into their financial strategy, individuals can create a more secure future for themselves and their families, ensuring they have a reliable safety net when it matters most.

5 Reasons Life Insurance is Your Best Financial Protection

Life insurance serves as a crucial safety net for your financial future. Here are five reasons why it should be an essential part of your financial planning:

- Financial Security for Dependents: In the event of your untimely passing, life insurance ensures that your loved ones are financially secure, covering daily living expenses, debts, and education costs.

- Debt Coverage: Life insurance can help cover any outstanding debts, including mortgages and personal loans, so your family won’t be burdened with financial liabilities.

- Peace of Mind: Knowing that your family will be taken care of in your absence brings significant peace of mind, allowing you to focus on enjoying life.

Moreover, life insurance can also play a pivotal role in long-term financial planning:

- Investment Opportunity: Certain types of life insurance, like whole life or universal life, build cash value over time, which can be accessed for emergencies or retirement.

- Tax Benefits: The death benefit provided by life insurance policies is often tax-free, making it a tax-efficient way to transfer wealth.

In summary, prioritizing life insurance is a smart financial decision that offers protection, peace of mind, and a pathway to a secure future.

Is Your Life Insurance Policy the Ultimate Safety Measure?

Life insurance is often seen as a crucial component of financial planning, providing not only peace of mind but also a safety net for loved ones in the event of an untimely death. As an investment in your family's future, a robust life insurance policy can offer financial protection that ensures your dependents can maintain their standard of living, pay off debts, and cover essential expenses. It serves as a layer of security that can prevent financial hardship during an already difficult time.

However, while life insurance is indeed a significant safety measure, it is essential to recognize that it should be part of a broader financial strategy. Relying solely on a life insurance payout may not address all potential risks. Consider diversifying your safety measures by incorporating savings, emergency funds, and other forms of insurance, such as health or disability coverage, to create a comprehensive protective framework. In this way, life insurance can complement your efforts to secure your family's financial future while addressing various life uncertainties.