Index Surge: Amplifying Your Insights

Stay updated with the latest trends and news across various industries.

Whole Life Insurance: A Lifetime Party Invitation for Your Finances

Unlock financial freedom with whole life insurance! Discover how it transforms your future into a lifetime celebration of wealth and security.

Understanding Whole Life Insurance: Benefits and Features Explained

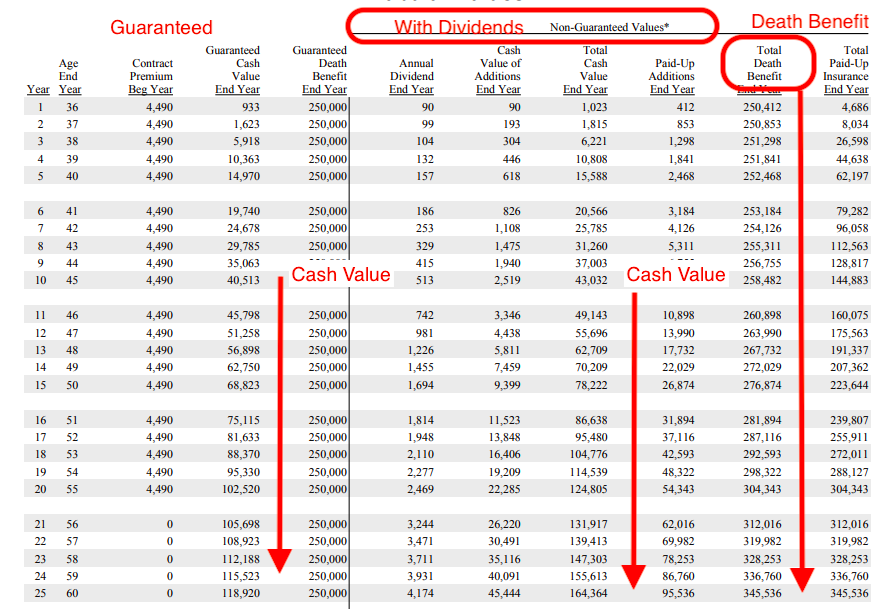

Whole life insurance is a type of permanent life insurance that provides coverage for the insured's entire life, as long as premiums are paid. Unlike term life insurance, which only offers coverage for a specific period, whole life insurance includes a savings component known as cash value. This cash value accumulates over time at a guaranteed rate, allowing policyholders to borrow against it or even withdraw funds if necessary. Additionally, the premiums for whole life policies remain level throughout the life of the policy, ensuring predictability in financial planning.

One of the primary benefits of whole life insurance is the peace of mind it offers, knowing that your loved ones will receive a death benefit regardless of when you pass away. Furthermore, the cash value component can serve as a financial resource in emergencies or for future investments. Other notable features include tax-deferred growth on the cash value and the ability to access this value without incurring income tax, making it a powerful tool for estate planning and wealth transfer. In summary, understanding the intricacies of whole life insurance can empower individuals to make informed decisions about their financial futures.

Is Whole Life Insurance the Right Choice for You? Key Considerations

When evaluating whether whole life insurance is the right choice for you, it's essential to consider your financial goals and needs. Whole life insurance offers lifelong coverage and includes a cash value component that grows over time. This means that, unlike term insurance, which expires after a set period, whole life insurance provides a guaranteed death benefit as long as premiums are paid. Additionally, the cash value can be accessed through policy loans or withdrawals, providing a source of funds during your lifetime. However, the higher premiums associated with whole life policies compared to term life may deter some individuals.

Another key consideration is your risk tolerance and investment strategy. While whole life insurance provides stability and guaranteed returns, it may not yield the same level of growth as other investment vehicles. Individuals looking for potential market gains may prefer term life insurance combined with separate investment accounts. Furthermore, assessing your current and future financial obligations, such as mortgage payments or children's education costs, can help determine if whole life insurance aligns with your financial planning. Ultimately, reviewing these factors with a qualified financial advisor can provide valuable insights tailored to your situation.

The Lifelong Financial Party: How Whole Life Insurance Supports Your Financial Goals

The Lifelong Financial Party: How Whole Life Insurance Supports Your Financial Goals

Whole life insurance is often viewed as merely a safety net, but it can actually be a lifelong financial party for you and your loved ones. By providing not only death benefits but also a cash value component that grows over time, whole life insurance can help you achieve financial goals in a stable and predictable way. This financial tool allows policyholders to accumulate savings on a tax-deferred basis, making it an excellent option for long-term wealth building. Consider how whole life insurance can serve multiple purposes in your financial strategy:

- Providing financial security for your beneficiaries.

- Acting as a safety net during emergencies.

- Building a cash reserve that can be accessed at any time.

Moreover, as you navigate through life, your whole life insurance policy can evolve with you, ensuring that your financial goals remain supported at every stage. The cash value can be borrowed against or withdrawn to fund significant life events, such as home purchases, education expenses, or retirement plans, effectively turning it into a versatile financial asset. To maintain the spirit of the lifelong financial party, it's crucial to regularly assess your insurance needs and make necessary adjustments. This dynamic approach not only secures your financial future but also cultivates a sense of financial independence, allowing you to savor life’s moments without the burden of financial uncertainty.