Index Surge: Amplifying Your Insights

Stay updated with the latest trends and news across various industries.

Whole Life Insurance: The Secret Weapon for Your Financial Fortress

Unlock the hidden power of whole life insurance and discover how it can fortify your financial future today!

Understanding Whole Life Insurance: Key Benefits for Your Financial Security

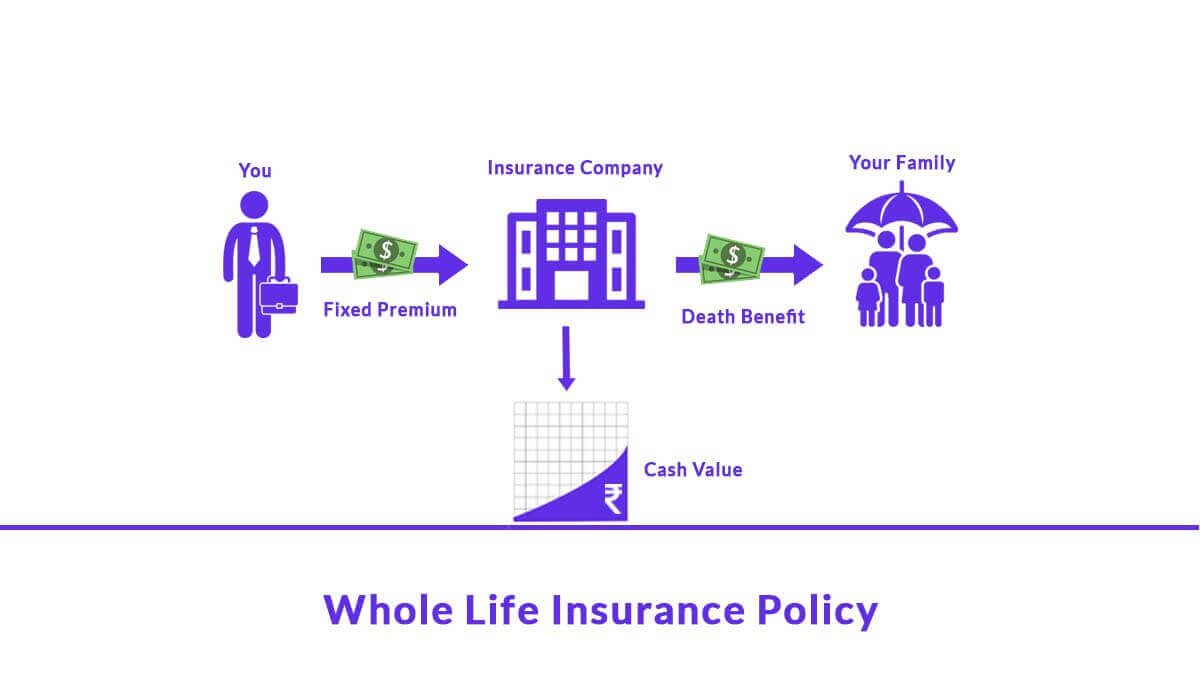

Whole life insurance is a type of permanent life insurance that offers not only a death benefit but also a savings component, making it an essential part of a well-rounded financial plan. One of the key benefits of whole life insurance is the guaranteed cash value accumulation. This means that as you pay your premiums, a portion of that money is set aside, growing over time at a guaranteed rate. Policyholders can borrow against this cash value or even withdraw it, providing a source of funds for emergencies or opportunities. Additionally, the death benefit payout is usually tax-free, making it a valuable tool for estate planning.

Another significant advantage of whole life insurance is the predictable premiums. Unlike term life insurance, where premiums can increase significantly upon renewal, whole life insurance offers fixed premiums for the life of the policy. This stability allows policyholders to better plan their finances. Furthermore, whole life policies often offer dividends, which can be reinvested in the policy, used to pay premiums, or taken as cash. This combination of fixed costs and potential for growth makes whole life insurance an attractive option for those looking to secure their financial future while ensuring peace of mind for their loved ones.

Whole Life Insurance vs. Term Life: Which is Right for You?

Whole life insurance and term life insurance serve different purposes, and understanding these differences is crucial when deciding which is right for you. Whole life insurance provides permanent coverage that lasts your entire life, as long as the premiums are paid. It also accumulates cash value over time, which can be borrowed against or withdrawn, giving it an investment component. In contrast, term life insurance offers coverage for a specified period, typically between 10 to 30 years. If you pass away during the term, your beneficiaries receive the payout. However, once the term ends, the coverage stops, and there is no cash value associated with the policy.

When choosing between whole and term life insurance, consider your financial goals and needs. Whole life insurance might be ideal for individuals looking for lifelong coverage and an investment opportunity, while term life insurance can be more suitable for those seeking affordable premiums to cover specific needs, such as raising children or paying off a mortgage. Assess your situation carefully and consult with a financial advisor if necessary to determine which option aligns better with your long-term financial plan.

How Whole Life Insurance Can Be a Powerful Savings Tool

Whole life insurance is often perceived purely as a means of providing financial protection for loved ones after one’s passing. However, it can also serve as a powerful savings tool. This type of insurance policy not only covers your life but also accumulates cash value over time, which can be accessed during your lifetime. As you make premium payments, a portion goes towards building this cash value, allowing you to borrow against it or even withdraw funds if necessary. Over the years, your cash value grows at a guaranteed rate, compounded annually, making it a reliable source of savings that can supplement retirement funds or cover unexpected expenses.

One of the key advantages of whole life insurance is its stability. Unlike other investments that may be subject to market fluctuations, the cash value of whole life policies grows steadily, providing a sense of security. Moreover, the funds accumulated within the policy can serve various purposes, including funding a child's education or providing a safety net for emergencies. By considering whole life insurance as part of a broader financial strategy, individuals can leverage its benefits not only for protection but also as an effective savings vehicle that helps achieve long-term financial goals.