Index Surge: Amplifying Your Insights

Stay updated with the latest trends and news across various industries.

Saving Cash While You Crash: The Hidden Auto Insurance Discounts You Didn't Know About

Unlock hidden auto insurance discounts and save big! Discover money-saving secrets now and keep your cash while you crash!

Top 5 Lesser-Known Auto Insurance Discounts You Might Be Missing

When it comes to auto insurance, many drivers are unaware of the various discounts that can significantly reduce their premiums. Beyond the standard discounts for safe driving records or multi-policy bundles, there are lesser-known auto insurance discounts that could save you money. For instance, some insurers offer discounts for low annual mileage. If you rarely hit the road, make sure to check if your insurer recognizes this; it can lead to substantial savings.

Additionally, defensive driving course discounts are often overlooked. Completing an accredited defensive driving course not only helps improve your driving skills but can also qualify you for a discount on your premium. Another potential discount comes from having a vehicle with advanced safety features, such as lane-keeping assist or automatic emergency braking. Many insurance companies provide discounts for these enhancements, recognizing their role in reducing accident risks. Don't miss out on these savings!

How to Identify Hidden Savings in Your Auto Insurance Policy

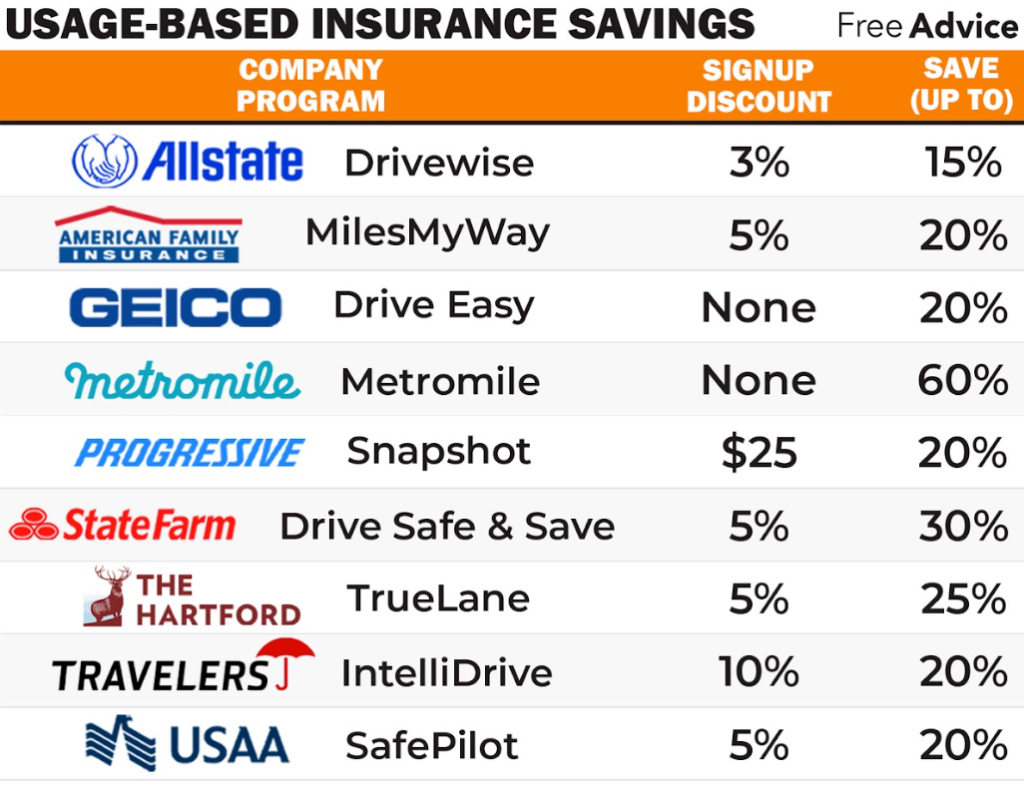

Identifying hidden savings in your auto insurance policy can be a game changer for your finances. Start by thoroughly reviewing your current coverage. Consider factors like your vehicle's age and mileage; you might be overinsured for a car that's depreciated significantly. Comparing quotes from different providers not only sheds light on premiums but also reveals potential discounts you might have missed. For example, many insurers offer reduced rates for bundling multiple policies, maintaining a clean driving record, or participating in safe driving programs.

Next, it’s essential to evaluate the discounts you may qualify for. Common discounts include those for good students, military personnel, and loyalty programs for long-standing customers. Additionally, consider assessing your deductibles: raising them can lower your premium, but do this cautiously, ensuring you can afford the out-of-pocket cost in an accident. Finally, don’t hesitate to contact your insurer directly to discuss your policy; they may provide insights or recommend adjustments that can ultimately lead to significant savings.

Are You Missing Out? The Secret Discounts Your Auto Insurance Company Won't Tell You

Are you aware that your auto insurance company could be hiding valuable discounts from you? Many insurance providers offer a range of lesser-known discounts that can significantly reduce your premiums. For example, some companies provide discounts for safe driving, bundling your policies, or even maintaining a good credit score. It's essential to proactively ask your insurer for a complete list of available discounts, as many are not publicly advertised. By inquiring about these options, you might be leaving a considerable amount of money on the table.

Additionally, consider your eligibility for discounts based on your vehicle's features or your driving habits. Anti-theft devices, for instance, can lower your insurance premiums quite a bit. Moreover, participating in a defensive driving course may not only make you a safer driver but also qualify you for additional savings. Remember that every little bit counts when it comes to reducing your overall insurance costs, so be sure to explore these secret discounts that your auto insurance company may not readily disclose.