Index Surge: Amplifying Your Insights

Stay updated with the latest trends and news across various industries.

Save More Than Just Pennies: Discover Hidden Auto Insurance Discounts

Unlock secret auto insurance discounts and save big! Discover tips to maximize your savings and keep more money in your pocket today!

10 Surprising Factors That Could Lower Your Auto Insurance Premium

When it comes to auto insurance, most people assume that factors like driving history and vehicle type play the largest roles in determining their premiums. However, there are surprising factors that can also significantly impact your auto insurance costs. For instance, your credit score is often considered by insurers when calculating your premium. A higher credit score may lead to lower rates, as it indicates responsible financial behavior. Additionally, the gender of the insured can influence premiums; statistically, fewer claims are filed by women, which might result in lower rates for female drivers.

Another unexpected element affecting your auto insurance premium is the occupation and education level you hold. Professionals in certain fields, like education or engineering, may be offered lower rates due to perceived lower risk. Moreover, the mileage you drive annually can play a surprising role as well; those who drive less often qualify for lower premiums because they are less likely to be involved in accidents. Lastly, even the location where you park your car—whether it's in a secured garage or on the street—can affect your premiums. All these factors combined create a more unique picture of your risk profile to the insurance provider.

Are You Missing Out on These Uncommon Auto Insurance Discounts?

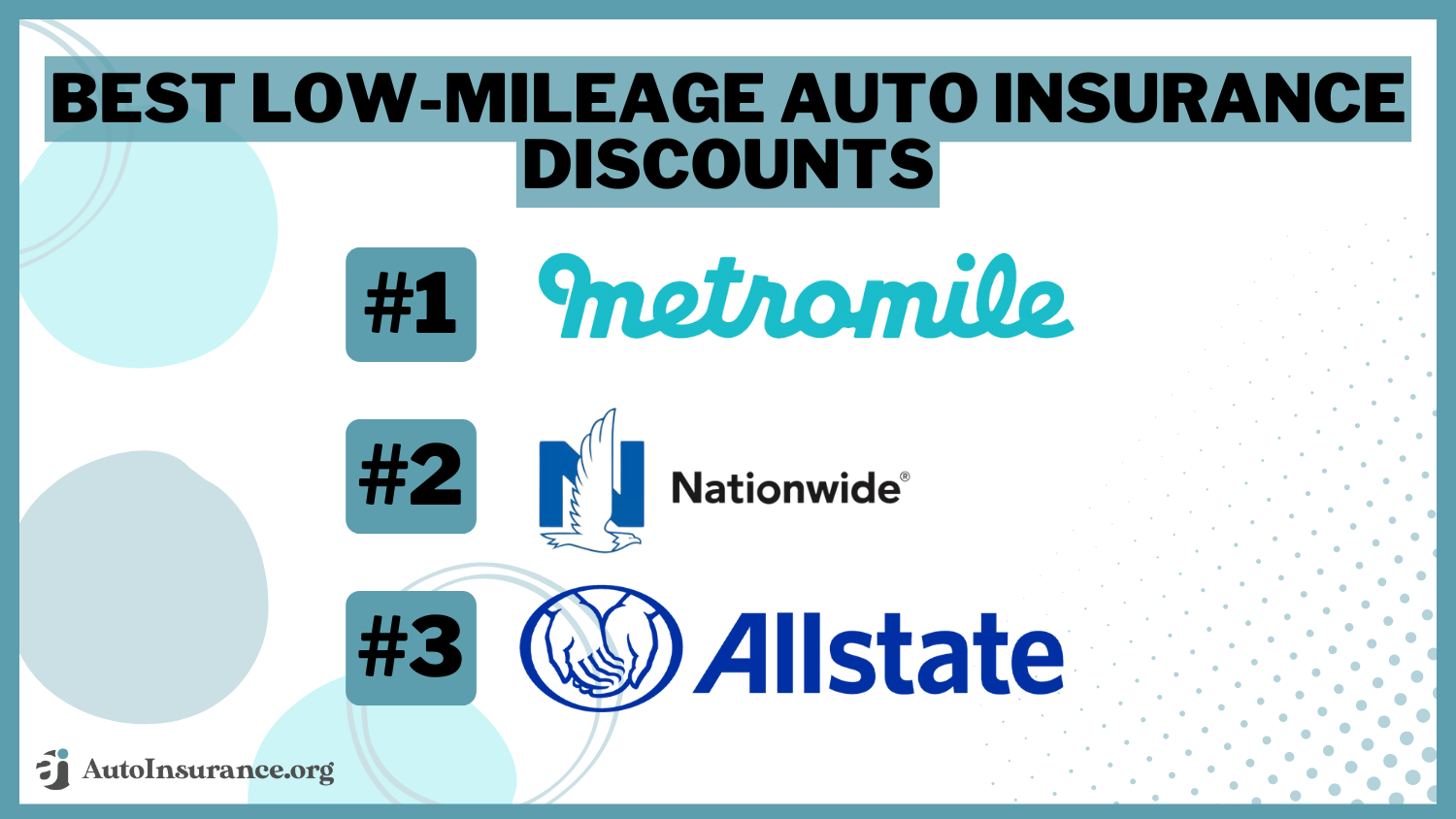

When it comes to auto insurance, most drivers are aware of the common discounts such as good driver credits or multi-policy savings. However, there are several uncommon auto insurance discounts that could save you a significant amount on your premium. For example, many insurers offer discounts for low annual mileage. If you primarily work from home or use public transportation, you may qualify for these savings since less driving translates to lower risk. Additionally, some companies will give discounts for being part of certain professions, such as teachers or military personnel, recognizing the contributions these individuals make to society.

Another often overlooked opportunity lies in the realm of vehicle safety features. Cars equipped with the latest technology like anti-lock brakes, automatic emergency braking, or advanced airbags can qualify for uncommon auto insurance discounts. Insurers appreciate that these features enhance safety and reduce the likelihood of accidents. Furthermore, if your car is equipped with tracking devices or you agree to usage-based insurance programs, you might also reap financial benefits. Make sure to check with your provider to see which discounts are available, as you could be missing out on significant savings!

How to Maximize Your Savings with Auto Insurance Discounts

When it comes to maximizing your savings on auto insurance, understanding the various discounts available is crucial. Many insurance companies offer a range of discounts that can significantly lower your premiums. For example, you may qualify for discounts based on your driving history, such as a clean record or completing a defensive driving course. Additionally, factors like bundling your auto insurance with home insurance or maintaining a good credit score can earn you substantial savings. Here are some key discounts to look for:

- Safe Driver Discounts

- Multi-Policy Discounts

- Good Student Discounts

- Low Mileage Discounts

Another effective strategy to maximize your savings is to regularly review your auto insurance policy and shop around for better rates. Insurance providers frequently update their pricing strategies, and you could be missing out on significant savings by sticking with the same provider. Don't hesitate to compare quotes from different companies and ask about any additional discounts they may offer. Furthermore, consider opting for a higher deductible, as this can result in lower premium payments overall. By being proactive and informed, you can ensure that you are getting the best value for your auto insurance coverage.