Index Surge: Amplifying Your Insights

Stay updated with the latest trends and news across various industries.

Quote Me If You Can: The Surprising Truth About Insurance Savings

Unlock the secrets to slashing your insurance costs and discover surprising savings you never knew existed! Click to learn more!

10 Common Insurance Myths Debunked: How to Save More

When it comes to insurance, misinformation is rampant, leading to the proliferation of myths that can cost consumers significantly. One common myth is that having insurance is always a waste of money. Many individuals believe that if they’ve never had to file a claim, their premiums are just an expense. However, insurance is designed to protect you from unforeseen circumstances. Consider it a safeguard against risks that could otherwise lead to substantial financial loss. Understanding this can help you see the true value of your policy.

Another prevalent myth is that all insurance policies are the same. In reality, there are various types of insurance, each tailored to meet specific needs. For instance, a homeowner's insurance policy is fundamentally different from an auto insurance policy. Therefore, it’s crucial to do your research and compare policies to find the best coverage for your situation. By debunking these common myths, you can make more informed decisions that ultimately save you money.

Is Your Insurance Premium Too High? Discover Hidden Discounts

Are you feeling burdened by rising insurance premiums? If so, you're not alone. Many consumers are searching for ways to lower their monthly costs without sacrificing coverage. One effective strategy is to discover hidden discounts that your insurance provider may offer. These discounts are often overlooked and can significantly reduce your premium, bringing you peace of mind. Start by reviewing your policy details and speaking with your agent about any potential discounts for things such as safe driving, bundling multiple policies, or maintaining a good credit score.

In addition to basic discounts, some insurers offer incentives for specific behaviors or attributes. Consider the following ways you might uncover more savings:

- Install safety devices: Installing security systems or anti-theft devices in your home or car can lead to substantial premium discounts.

- Maintain a clean record: A history of no claims can qualify you for a loyalty discount.

- Ask about membership benefits: Some organizations and associations provide members with exclusive discounts on insurance.

By actively seeking out and utilizing these hidden discounts, you can take control of your financial health and ensure that you're not paying more than necessary for your insurance coverage.

Understanding Insurance Quotes: What You Need to Know to Save Big

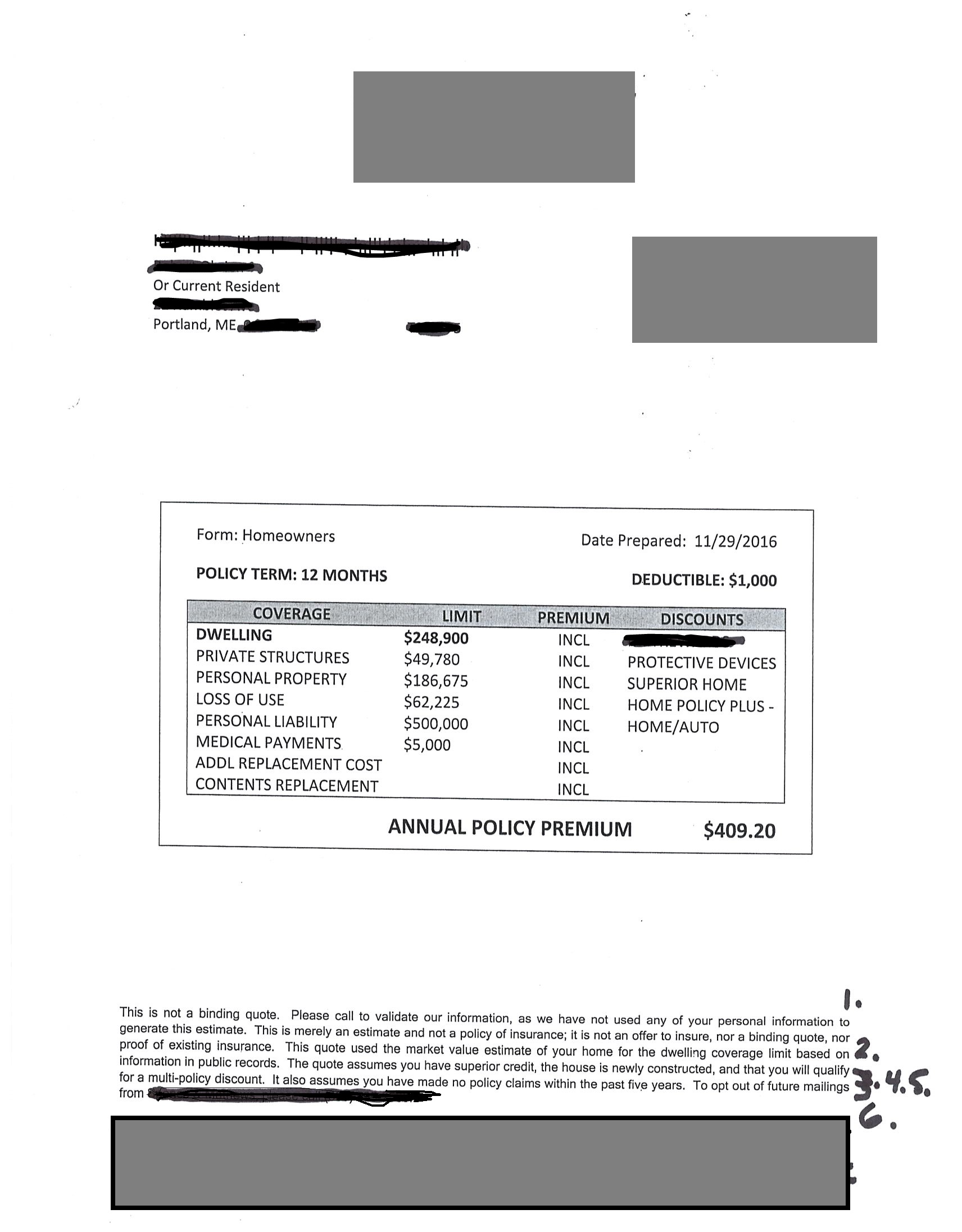

When it comes to understanding insurance quotes, it’s essential to recognize that these estimates can vary significantly from one insurer to another. Each company uses its own pricing models, which are based on factors such as your age, location, and driving record for auto insurance, or your home's value and claim history for homeowner's insurance. To save big, you should gather multiple quotes and compare them side by side. Consider creating a spreadsheet to track details such as coverage limits, deductibles, and premium costs. This approach will not only help you to identify the best deal but also to understand the coverage you are receiving for the price you're paying.

Furthermore, it's important to read the fine print on each quote to avoid any surprises down the line. Some policies may seem more affordable but could have hidden fees or less comprehensive coverage. Focus on comparing apples to apples when looking at your options. Always ask potential insurers about discounts that you might qualify for, such as multi-policy discounts, good driver discounts, or safety feature discounts. By being diligent and well-informed about your insurance quotes, you can confidently choose a policy that not only fits your budget but also provides adequate protection for your needs.