Index Surge: Amplifying Your Insights

Stay updated with the latest trends and news across various industries.

Insuring Your Peace of Mind: What Policies Really Cover

Discover the hidden truths behind insurance policies and learn what truly protects your peace of mind. Don't get caught off guard!

Understanding the Fine Print: What Your Insurance Policy Covers

When it comes to understanding insurance policies, it’s crucial to delve into the fine print. Many policyholders overlook specific terms and conditions that can significantly impact their coverage. Start by examining the declarations page, which summarizes your coverage limits, deductibles, and premium. Remember that not all damages or events may be included under your policy; specific exclusions, such as flooding or earthquakes, are often detailed in the policy document. Familiarizing yourself with these exceptions can save you from surprises when filing a claim.

In addition to exclusions, be aware of the endorsements that can modify your coverage. These are adjustments made to tailor your policy to your specific needs, whether it’s adding additional living expenses coverage or increasing your liability limits. To make informed decisions, consider discussing your policy with an agent who can clarify complex terms and suggest options that suit your lifestyle. By taking the time to understand the fine print and actively engaging with your insurance provider, you can safeguard your financial future and ensure you're adequately protected.

Common Misconceptions About Insurance Coverage: What You Need to Know

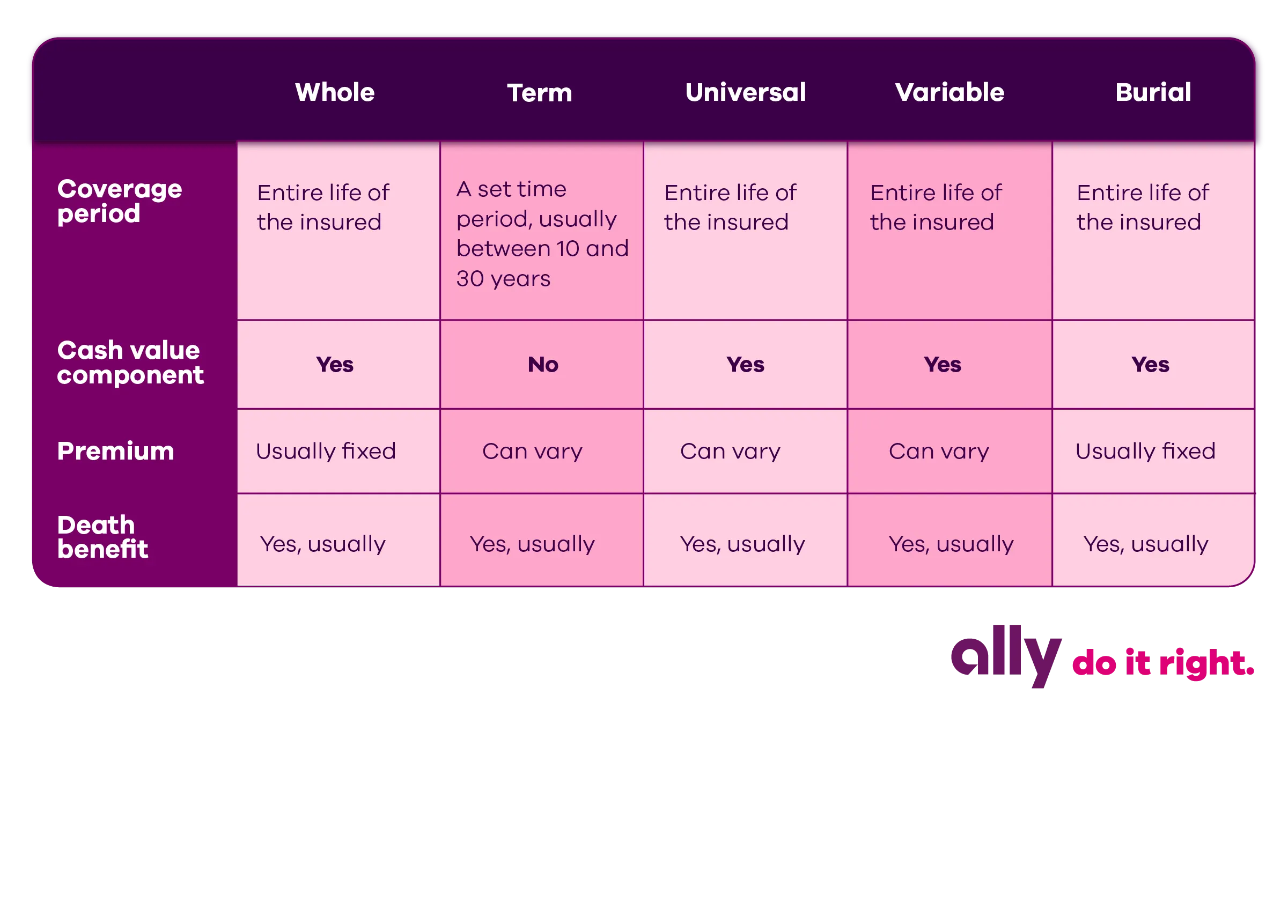

When it comes to insurance coverage, many individuals harbor misconceptions that can lead to serious financial consequences. For instance, one common myth is that all types of insurance policies are interchangeable. In reality, different policies—such as health, auto, and home insurance—have unique benefits and limitations tailored to specific needs. It’s crucial for policyholders to understand these nuances to ensure they have the appropriate coverage for their circumstances.

Another prevalent misconception is that having insurance means you are fully protected from all financial risks. However, policies often come with exclusions and limitations that may not be immediately apparent. For example, certain natural disasters might not be covered under a standard homeowner's policy. To avoid unexpected gaps in coverage, it is advisable to read your policy documents thoroughly and consult with an insurance professional to clarify any uncertainties.

Is Your Policy Enough? Key Questions to Ask About Coverage

When it comes to insurance, understanding the adequacy of your policy is crucial for protecting your assets. To ensure that you’re fully covered, ask yourself the following key questions: Is your policy comprehensive enough to cover natural disasters or other unforeseen events? Many policies have exclusions that could leave you vulnerable, so it’s essential to review the fine print. Additionally, consider whether your coverage limits align with the current value of your possessions; underinsuring items can lead to significant financial loss.

Another important aspect to assess is the extent of liability coverage. Evaluate whether your current policy protects against potential claims that could arise from injuries or damages caused by you or your property. Consider asking: How much liability coverage do you really need? It might also be beneficial to consult with an insurance professional to better understand your risks and ensure you have adequate coverage. By addressing these key questions, you can gauge if your policy is indeed enough to safeguard your financial well-being.