Index Surge: Amplifying Your Insights

Stay updated with the latest trends and news across various industries.

Insurance on a Shoestring: How to Save Big Without Sacrificing Coverage

Unlock huge savings on insurance without compromising coverage! Discover clever tips in Insurance on a Shoestring. Save big today!

Top 10 Tips for Cutting Insurance Costs While Keeping Your Coverage

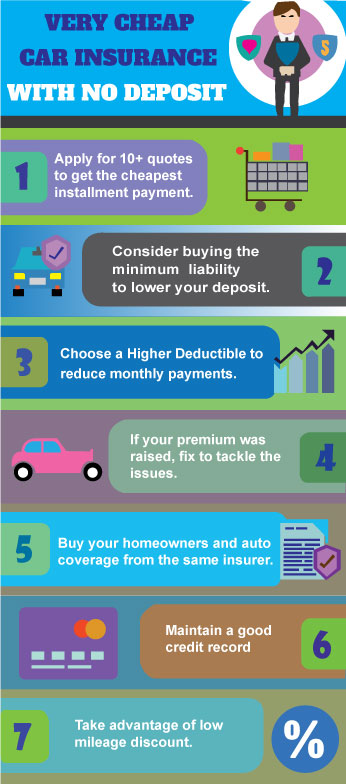

Reducing your insurance costs while maintaining adequate coverage is a challenge many individuals face. Here are top tips to help you achieve that balance:

- Review Your Coverage: Regularly assess your policy to ensure you're not paying for unnecessary add-ons or features that you don't utilize.

- Increase Your Deductible: Opting for a higher deductible can significantly lower your premium, but ensure you can afford the deductible in case of a claim.

- Bundle Policies: Consider consolidating your auto, home, and other insurance needs with one provider to take advantage of multi-policy discounts.

Additionally, you can implement these strategies to enhance your savings:

- Maintain a Good Credit Score: Insurers often use your credit history to set premiums, so keeping your score high can lead to lower costs.

- Take Advantage of Discounts: Inquire about available discounts for safe driving, being a good student, or having security systems installed.

- Shop Around: Don’t hesitate to compare quotes from different insurers to find the best rate that maintains your coverage.

Understanding Insurance Deductibles: How to Save Money Without Sacrificing Protection

Understanding insurance deductibles is crucial for both saving money and maintaining adequate coverage. A deductible is the amount you pay out of pocket before your insurance company starts to contribute. Choosing a higher deductible often results in lower premium payments, which can help you save significantly over time. However, it's essential to assess your financial situation to determine the right balance between a manageable deductible and affordable premium costs.

To maximize your savings while ensuring you have sufficient protection, consider the following strategies:

- Choose the right deductible: Analyze your budget to find a deductible amount that won't put you in a financial bind.

- Bundle your policies: Many insurance providers offer discounts for bundling multiple policies, which can reduce costs across the board.

- Review and compare rates: Regularly shop around for new quotes and discounts from different insurers to find the best deal.

Is Bundling Your Insurance Policies Really Worth It?

Bundling your insurance policies can be a strategic decision for many consumers looking to save money and simplify their coverage management. When you combine multiple policies, such as auto and home insurance, with the same provider, you often unlock significant discounts. These savings can range from 5% to as much as 25% off the total premiums. Additionally, having a single point of contact for all your insurance needs can enhance your overall customer experience, making it easier to manage claims and policy updates.

However, it’s essential to evaluate whether bundling is truly beneficial for your specific situation. While the potential for savings is appealing, it’s crucial to assess the coverage options available within bundled packages. Sometimes, opting for separate policies from different insurers may provide better coverage for unique needs without compromising on critical protections. Therefore, before making a decision, consider comparing quotes from multiple providers and analyzing the overall benefits compared to staying with a single insurer.