Index Surge: Amplifying Your Insights

Stay updated with the latest trends and news across various industries.

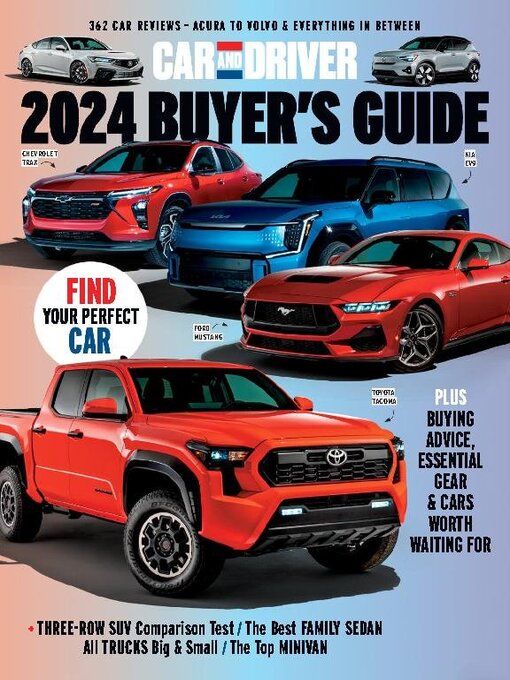

The Hidden Truths Your Dealer Won't Tell You

Discover the shocking secrets your dealer won't share! Unveil hidden truths that can save you money and stress. Click to learn more!

5 Hidden Costs of Buying a Car You Need to Know

Buying a car often involves more than just the sticker price. One of the hidden costs of buying a car is the depreciation that occurs the moment you drive off the lot. On average, a new car can lose up to 20% of its value within the first year. This is a crucial factor to consider, especially if you plan to sell or trade in the vehicle in the future. Additionally, buyers may overlook sales tax, which can significantly add to the overall cost, depending on local tax rates.

Another hidden cost comes from maintenance and repair expenses that are often underestimated. Regular services, tires, and unforeseen repairs can lead to substantial bills. According to industry standards, you should budget about $500 to $1,000 annually for maintenance once the warranty expires. Finally, insurance premiums can vary widely based on the car model, your driving record, and location, which adds another layer to the total cost of ownership. Always remember to consider these costs in your budget before making a purchase.

The Dark Side of Car Financing: What Dealers Don’t Tell You

The allure of a new car often blinds buyers to the dark side of car financing. Many dealerships promote financing deals that seem irresistible, but beneath the glossy ads lie hidden fees and pitfall clauses. For instance, a dealer might advertise 0% financing, but fail to disclose that this rate applies only to select models, or that you must have impeccable credit to qualify. Additionally, many buyers overlook add-ons like gap insurance or extended warranties that can inflate the overall cost. As a result, a vehicle that seemed affordable can quickly become a financial burden.

Furthermore, dealerships often employ high-pressure sales tactics to rush decisions, which can lead to mistaking information for urgency. Commonly, they may provide misleading information about your financing options or downplay the importance of shopping around. This lack of transparency can trap unsuspecting buyers in unfavorable loan agreements that affect their financial health for years. To navigate the complexities of car financing, it is crucial to conduct thorough research and consider obtaining pre-approval from banks or credit unions before stepping foot in a dealership.

Are You Getting the Best Deal? The Secrets Dealers Don't Want You to Uncover

When it comes to purchasing a vehicle, understanding how to get the best deal is crucial. Many buyers walk into a dealership without knowing the true value of the car they are interested in, which plays directly into a dealer's hands. To avoid falling into this trap, it’s essential to do your homework beforehand. Start by researching the market value of the vehicle you want, considering its make, model, year, and condition. Websites such as Kelley Blue Book or Edmunds can provide valuable insights into fair pricing. Additionally, checking for any current promotions or manufacturer incentives can give you an edge during negotiations.

Another secret dealers don’t want you to uncover is the power of timing. Buying a car at the right moment can significantly impact your savings. For instance, shopping at the end of the month or during holiday sales when dealerships are eager to meet sales quotas can yield better deals. Moreover, be prepared to walk away if the terms aren’t favorable; this tactic often leads to unexpected offers. Remember, being well-informed and patient can lead to substantial savings, ensuring you walk away with the best deal possible on your new ride.