Index Surge: Amplifying Your Insights

Stay updated with the latest trends and news across various industries.

Compare It or Regret It: The Insurance Dilemma

Discover the key to smart insurance choices! Compare options today to avoid costly regrets tomorrow. Don't miss out!

Understanding Your Insurance Options: A Comprehensive Guide

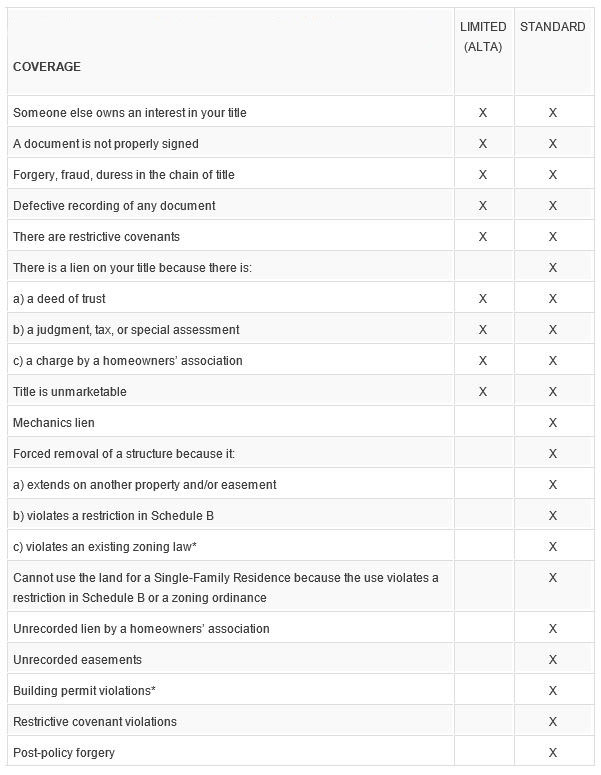

Understanding your insurance options is crucial for protecting yourself and your assets. With a multitude of policies available, from health to auto and homeowners' insurance, it can be overwhelming to navigate the landscape. Begin by assessing your needs: consider factors like your lifestyle, income, and potential risks. For instance, health insurance is essential if you have ongoing medical needs, while auto insurance is mandatory if you own a vehicle. Take the time to research various providers and the coverage they offer, comparing premiums and policy terms to find the best fit for your situation.

Once you have a clearer picture of your requirements, it's important to delve deeper into the specifics of each insurance type. For example, under homeowners' insurance, you can choose between different levels of coverage, such as basic, broad, or special form policies. Additionally, consider any endorsements or riders that may add valuable protections tailored to your needs. Don't hesitate to reach out to insurance agents for personalized advice—asking the right questions can illuminate your options and help you make informed decisions. Remember, understanding your insurance options not only safeguards your assets but also provides peace of mind.

The Cost of Regret: Why Comparing Insurance Policies Matters

When it comes to securing your financial future, comparing insurance policies is not just a prudent step—it's a crucial one. The cost of regret is often felt when individuals realize they've chosen a policy that doesn't fully meet their needs. By taking the time to evaluate the various options available, you can ensure that the coverage you select aligns with your personal circumstances and financial goals. The consequences of neglecting this important task can manifest in numerous ways, including inadequate coverage in times of crisis and potentially significant out-of-pocket expenses.

Moreover, comparing insurance policies empowers you to make informed decisions that can save you money in the long run. With a myriad of options available in the market, understanding the differences in coverage, premiums, and deductibles can lead to significant savings. Consider using a simple checklist to evaluate each policy:

- Coverage limits

- Premium costs

- Deductibles

- Exclusions

By meticulously reviewing these aspects, you can avoid the pitfalls associated with hasty choices and ensure you select a policy that offers both affordability and comprehensive protection.

Is Your Insurance Policy Right for You? Key Questions to Ask Before You Decide

Choosing the right insurance policy is crucial for protecting your assets and ensuring peace of mind. To determine if your insurance policy is right for you, start by asking yourself a few key questions:

- Do I fully understand what my policy covers?

- Are the coverage limits appropriate for my needs?

- Am I paying for any unnecessary riders or add-ons?

Next, evaluate the affordability and terms of your policy. Consider asking:

- Is my premium reasonable compared to the coverage provided?

- What is my deductible, and can I comfortably afford it in the event of a claim?

- Are there any discounts available that I might qualify for?